Blockchain Trilemma

At its core, blockchain technology allows decentralized processing of payments, without relying on a central middlemen. Critics often dismiss cryptocurrencies as slower, less efficient payment systems compared to what banks or Visa offer today. However, this viewpoint misses a fundamental breakthrough: Bitcoin can replicate the Visa network’s function without a centralized party, trading speed for security. To understand why that trade-off exists, we need to dive into the concept of Blockchain Trilemma and how different networks like Ethereum and Binance Smart Chain choose different compromises.

At its core, blockchain technology allows decentralized processing of payments, without relying on a central middlemen. Critics often dismiss cryptocurrencies as slower, less efficient payment systems compared to what banks or Visa offer today. However, this viewpoint misses a fundamental breakthrough: Bitcoin can replicate the Visa network’s function without a centralized party, trading speed for security. To understand why that trade-off exists, we need to dive into the concept of Blockchain Trilemma and how different networks like Ethereum and Binance Smart Chain choose different compromises.

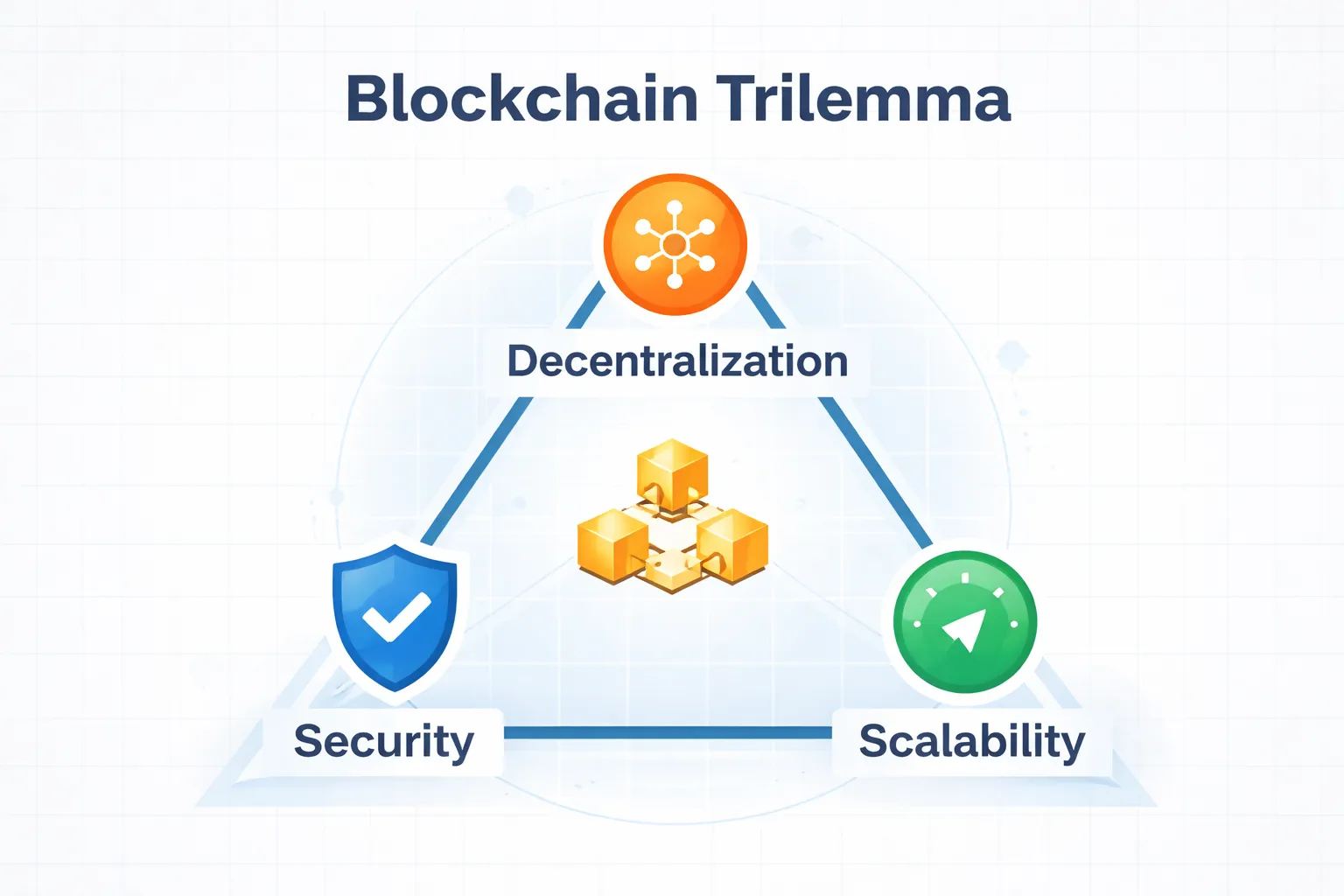

What is the Blockchain Trilemma?

The blockchain system has three core goals: decentralization, security, and scalability. Any blockchain can maximize two of these, but must sacrifice the third to some degree. It’s like the old project management adage “fast, cheap, good – pick two.”

- Decentralization: Many independent participants (nodes/validators) share the network’s control, instead of one central authority. This is akin to having many property registrars across different regions maintaining a land ledger, rather than a single government office. Decentralization ensures no single party can unilaterally alter records or censor transactions

- Security: The system’s resistance to attacks or fraud. In blockchain, security often improves with more decentralization. The more independent nodes verifying data, the harder it is for anyone to hack or falsify records. (Imagine a property deed system where hundreds of auditors must all agree a title transfer is legitimate, it would be extremely hard for a fraudster to deceive everyone at once.)

- Scalability: The ability to handle a high volume of transactions quickly (high throughput, low latency). For blockchains, scalability is measured in transactions per second (TPS). Traditional networks excel here. For example, Visa’s network can process thousands of payments per second (up to ~24,000 TPS), whereas early blockchain networks process far fewer (Bitcoin handles under 10 TPS; Ethereum around 15 TPS in 2021). High scalability often requires more efficient, centralized control to avoid bottlenecks. it's the difference between submitting your work right after doing it and needing to verify it with thousands of other independent entities first.

A fully decentralized and secure system (lots of independent verifiers keeping it honest) will, by nature, be slower or harder to scale. If you want scale (speed and throughput), you usually either centralize more (fewer, more powerful nodes) or accept some security trade-offs. It’s a balancing act that every blockchain project grapples with.

Trilemma Through the Lens of Real Estate

Consider how property records are maintained today. We rely on a central county clerk’s office to update and verify property titles. This system is centralized. To mitigate risk, the buyers pays "title insurance" to a centralized entity at the time of purchase that performs a background check on the property. The "insurance" portion of that protects the investor in the event that the records are wrong or there is an issue with the property. In order for this system to work, we have to trust the centralized entity tracking the records. But what happens if the centralized entity has a problem with the records and there is no "insurance" to remedy the problem? We have to accept sacrifices.

Indeed, we have seen multiple such cases throughout history, even if they don't easily come to mind. In 1980, The Great Chelsea Fire destroyed a 3rd of Chelsea, MA - including the city hall that kept all the property records. As a result, despite many properties in Chelsea pre-dating 1908, that's as far as the records go. My own rental in Chelsea claims to have been built in 1908, despite still having gas-lamp connections that stopped being installed around 1890.

Now imagine a decentralized property ledger: hundreds of registrars or computers worldwide each keep a copy of the property records, and every time a house is sold, all of them must update their ledgers and agree on the change. This would be incredibly secure and tamper-resistant (no single clerk could alter a title without consensus), and fraudulent sales would be nearly impossible because the network collectively validates each transaction. However, there is significant overhead in getting all those parties to agree on each update (scalability issue). This is the trilemma: our decentralized property system sacrificed speed for security and trustlessness.

Conversely, if we let just one company manage all property data digitally, transfers could be instant (high scalability), but we’d have to fully trust that company’s security and integrity (losing decentralization and introducing a single point of failure). Blockchains try to strike a balance among these factors depending on their goals.

Why Decentralization Matters

At first glance, Bitcoin’s network processing ~5–7 transactions per second looks inferior to Visa’s thousands per second. Critics ask: why use a “shaky, slow” system when our centralized payment networks are fast and reliable? The answer lies in what we gain by removing the central intermediary.

Visa and bank networks are fast because they’re centralized. A Visa transaction involves your bank and the merchant’s bank communicating through Visa’s private network. But when you swipe your card, Visa isn’t actually settling the money on the spot; it’s authorizing the transaction. Final settlement (actual movement of funds between banks) happens behind the scenes and can take days, and you as a customer can even reverse charges (chargebacks). In other words, the system is fast because Visa takes on the risk and trust: we trust Visa and banks to eventually sort out the money. There’s always a third party “in charge” of making it right, and we pay fees for that service.

Bitcoin flips this model on its head. When a Bitcoin transaction is confirmed on the blockchain, it’s settled (truly finalized) within about 10 minutes, with cryptographic proof and no ability for anyone to unilaterally reverse it. There is no central authority that can cancel or block the payment, and every participant on the network agrees on the outcome. It’s slow if you compare raw speed, but it combines processing and settlement into one step. Moreover, it’s open to anyone and censorship-resistant. No bank or company can refuse to process a valid transfer or impose arbitrary conditions. In the real estate world, that’s like being able to transfer property to someone without needing a bank, escrow, or registry office at all. Once the network records it, the transfer is done, and no court or clerk can undo it.

This is a big deal. Bitcoin demonstrated that value can be moved globally without trusting a central clearinghouse, something impossible in traditional finance. Yes, we currently pay for that with slower throughput and higher latency, but many believe the trade-off is worthwhile for transactions where trust and security are paramount. Just as you might wait a few days for a deed to record but value the certainty of a proper title, Bitcoin users wait for confirmations but value that no single institution needed to facilitate or guarantee the payment. In short, decentralization provides a new kind of security – one backed by math and consensus rather than legal contracts and intermediaries.

Eliminating Middlemen

Most of our systems today rely on centralized middlemen, as in the Visa example above. This creates a conflict of interest in some cases, when middlemen act both as the referee and the player. Indeed, the 2008 financial crisis (which was the motivator for Bitcoin development) showed us that even large financial institutions are not above cheating. There are multiple others cases of such "cheating", such as 2012 Cypress bail-in when banks decided to take the depositors' money to stay solvent. Even the concept of inflation is a form of cheating. It's a hidden tax on your savings by The Fed that prints new money, devaluing existing monetary supply in the process.

In addition to "black swan" event risks that centralized middlemen introduce, they're also more expensive. An algorithm is always going to be cheaper than having a human in the loop.

Ethereum vs Binance: A Case Study in Trade-Offs

Two well-known blockchain platforms, Ethereum and Binance Smart Chain (BSC), illustrate the trilemma in action. Both can run smart contracts (programmable transactions), but they made different design choices:

Two well-known blockchain platforms, Ethereum and Binance Smart Chain (BSC), illustrate the trilemma in action. Both can run smart contracts (programmable transactions), but they made different design choices:

Ethereum is highly decentralized and secure, but struggles with scalability. Ethereum was secured by thousands of independent nodes worldwide (around 77,000 as of this writing). This broad decentralization makes Ethereum very resilient and trustworthy – no single entity controls it. However, the current version of Ethereum (powered by the same proof-of-work approach as Bitcoin itself) processes only around 15 transactions per second, and as DeFi ecosystem is growing, Ethereum is becoming too congested/expensive to transact on. Transaction fees (“gas”) spiked to painful levels because demand outstripped throughput.

Binance Smart Chain (BSC) is a newer network (launched in 2020) that took a “fast and cheap, with some centralization” approach. BSC is much faster and more affordable per transaction – it can handle far more transactions per second than Ethereum, with low fees. BSC sacrifices decentralization for scalability. Instead of thousands of nodes, BSC uses just 21 active validators (computers/parties validating transactions) at any given time. These validators are not independent either, they're owned by Binance, the company that created BSC. In real estate terms: BSC is like a privately run title registry that’s very fast and efficient, but essentially run by one large company (Binance) with a handful of appointed offices. It works well and cheaply as long as you trust Binance and its validators to be honest and competent, but it doesn’t deliver the same trustless neutrality that Ethereum aspires to. It's effectively the same Ethereum protocol deployed by a private entity.

BSC’s design shows that a faster version of Ethereum is indeed possible, if you’re willing to trust a centralized structure. By having only 21 validators (rather than thousands of nodes), the network reaches consensus quickly (fewer parties to communicate with) and can crank through more transactions. It solves the user experience problem of high fees and slow confirmations that Ethereum users face. BSC also shows us the the real problem is not the protocol itself, which can easily compete with Visa's throughput when it doesn't need to focus on decentralization, but rather that building a secure trustless system is no easy feat.