Crypto Basics: Networks, Coins, and Tokens

Bitcoin introduced us to the concept of democratized currencies, ones not owned by the government. Bitcoin's success led to the creation of other cryptocurrencies, such as Litecoin and Dogecoin. However, it was Ethereum that truly revolutionized the crypto world. Launched in 2015, Ethereum is not just a cryptocurrency but also a decentralized platform that enables the creation of smart contracts and dApps. dApps are applications that run on a decentralized network of computers rather than a centralized server.

Bitcoin introduced us to the concept of democratized currencies, ones not owned by the government. Bitcoin's success led to the creation of other cryptocurrencies, such as Litecoin and Dogecoin. However, it was Ethereum that truly revolutionized the crypto world. Launched in 2015, Ethereum is not just a cryptocurrency but also a decentralized platform that enables the creation of smart contracts and dApps. dApps are applications that run on a decentralized network of computers rather than a centralized server.

Ethereum allowed us to create new types of applications, including decentralized finance (DeFi) applications, which allow users to lend, borrow, and trade cryptocurrencies without the need for intermediaries such as banks. While many of us are now familiar with cryptocurrencies, the terminology is still widely misused. For example, names of networks and coins used to represent them are often used interchangeably. Similarly, tokens and coins are often confused. So let's clarify both of these.

Networks vs Coins

Ethereum is a network, ETH is a coin used to settle transactions on this network. They're often used interchangeably, but they're not the same thing. The confusion stems partially from the fact that Bitcoin is both a network and a coin, and at the time of Bitcoin creation differentiating between the two wasn't necessary. Today, many of the networks no longer share a name with the coin used on the network. Some notable examples include Ripple, Polygon, and Harmony. In fact, Polygon actually rebranded their network name while leaving the coin name unchanged. As networks become more decentralized, this distinction will probably matter even more. We may end up in a situation where the same coin is used on multiple networks (this is already the case with USDC), or different organizations influence network/technology decisions and coin/economic decisions. The distinction between a network and a coin may seem subtle, but it's an important one.

Coins vs Tokens

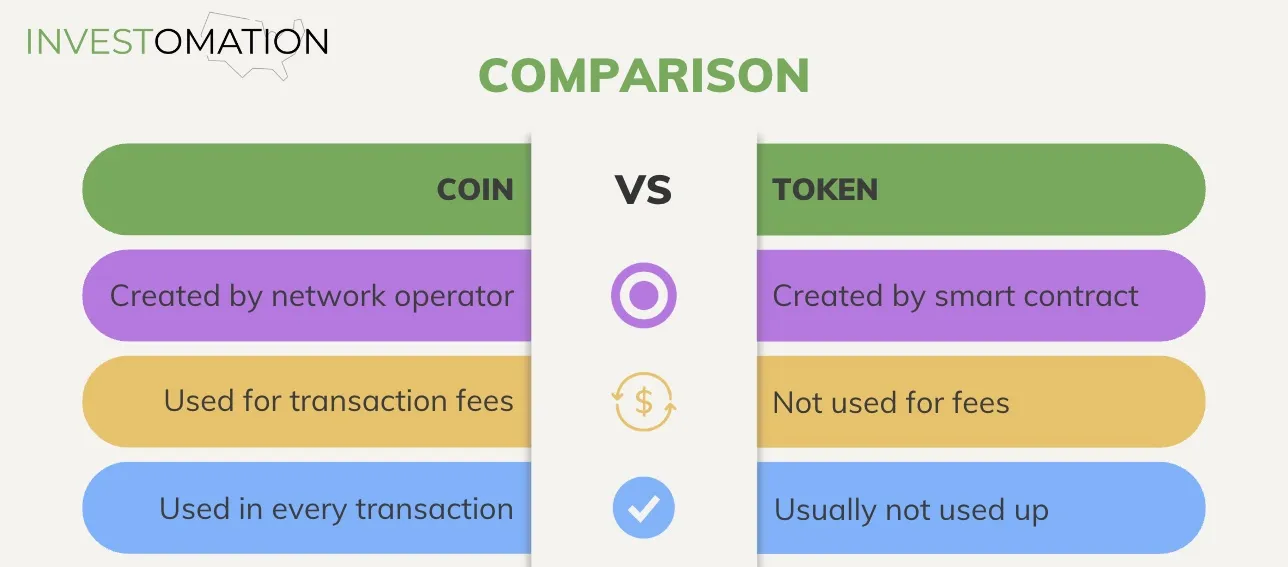

Like the previous terms, the terms "coins" and "tokens" are used interchangeably. These terms, as you may already have guessed, are not the same either. One is an actual payment method, while the other works more like a fractional share of a project running on that network.

Network coins function as the native currency of a blockchain network. These coins are used to pay transaction fees, incentivize network participants, and maintain the security of the network through mining or staking. One of the most well-known examples of a coin is ETH, which is used to settle transactions on the Ethereum network. A transaction is any transfer of money between 2 wallets (whether that wallet is controlled by a human or a smart contract).

Actually the name coin is a misnomer (although same can be said about the term "cryptocurrency"), a more accurate description of it is gas (and that is indeed how it's often referred to in the DeFi community). Gas is used to "lubricate" transactions together so that they don't get stuck. Any message sent on the network will use gas. And yes, using more "lubricant" does speed up transactions.

Tokens, on the other hand, are digital assets that are created on top of an existing blockchain network, such as Ethereum. Tokens can represent any asset, such as commodities, real estate, or even other cryptocurrencies. When a token represents a different token/coin, it is called "wrapped". And yes, you've guessed it, there is a wrapped version of ETH as well. It's called WETH and is a token that's used to represent a coin. This further adds to the coin-token confusion. Some well-known tokens include AAVE, and UNI (Uniswap). Aave is a lending platform that lives on top of the Ethereum network as a dApp, and Uniswap is a decentralized exchange (this is a DeFi version of a brokerage).

Digital Franchises

Tokens are often tied to a smart contract (usually immutable, meaning that its operation can't change), a smart contract that usually puts them to work through creation of incentives. For this reason, tokens can often be put to work to create additional revenue (at least in theory, in practice the risk often outweighs reward).

As the network grows and edge cases are ironed out, a well-designed smart contract can generate continous cashflow - usually by collecting fees from users relying on the service. The service can be anything from risk mitigation to providing liquidity. In the future, with Oracles and new types of networks, the definition of "service" can be expanded further. Helium network sells its network coverage to pay the people running its network, by placing antennas on their roof. Filecoin sells decentralized encrypted storage. Ethereum is basically the AWS of dApps. Here at Investomation, we're actually working hard to do the same thing for real estate. For that reason, a token in a well-crafted smart contract is often seen as an asset and functions a lot like a digital version of a franchise.

It actually shares a lot in common with franchies. The rules are well-defined and investors use prior operation history to judge the quality of purchase. Once purchased, the operation can be put to use to generate consistent revenue. The operations are ran by the entity who built the franchise, but the risk is carried by the investor. This digital franchise capability is widely misunderstood and underappreciated.