Mathematics of Inflation

We often stall before an important decision like buying our first home or investing in real estate. Some of us stall for years. We've come to see stalling as the safe choice with worst case scenario being the same as current situation. But stalling is never a safe choice, as many people priced out of real estate market will know. The main problem with stalling is inflation.

Inflation affects everyone, whether you're in real estate or not. What most people don't know is that actual inflation is higher than the 1-3% per year figure government claims in their spreadsheets. A typical home in Boston used to cost less than $20k in 1970. If you plug that into an inflation calculator which uses government-claimed inflation rate, it will tell you that the same home should cost about $130,000 today (2020). But anyone living in Boston knows that this price hasn't existed since 2000. Today's median home price is $653k, according to Zillow. If you plug that into a reverse inflation calculator, you'll see that the real inflation rate we experienced is over 5%. This figure isn't unique to Boston, most healthy cities experienced similar inflation.

Either intentionally (to keep the masses calm) or unintentionally (bureaucratic ignorance), the US Bureau of Labor Statistics is omitting some of our most expensive purchases from their index. Instead, they focus on metrics for consumer goods that benefit from mass production which drives prices down faster than inflation (such as electronics). It's a metric that's at best inaccurate, and dangerous when we're basing our life decisions on it.

At 1% inflation, stalling before jumping into real estate may indeed be a safe choice. But at 5% annual tax on all of your savings (which is effectively what inflation is), you can't stall because you're standing in quicksand. This is the concept many savers don't understand, The Fed has rigged the game against them. Savings erosion is by design, it's part of our inflationary economy. If you need more convincing that actual inflation rate in US is 5%, take a look at other signs, such as average rent increase rate, or Dow Jones historical average of 5.4%. After all, what better way to capture the inflation rate than by looking at the total monetary price of US businesses over time?

Savers ultimately lose money, you need to stay in the stock market or real estate just to avoid eroding your existing purchasing power. Don't be fooled by food and electronics prices. Those savings are due to technology, a force more powerful than inflation, but that's a whole other article (also read Peter Diamandis' Abundance: The Future Is Better Than You Think, a great book on this topic). For a better understanding of actual inflation, look at the price trends of home ownership, education, and medical bills. In fact, your medical bills can provide some insight into what's actually happening with technology. While the cost of individual tech is indeed going down, the cost of new tech taking its place is going up, and that's the true inflation cost because in 2021 you'll be buying a car, not a horse.

The good news is that you have the option to buy a car, something your ancestors did not. Technological advancement makes everyone in the society richer, but if you want to keep your status within that society, you have to keep up with inflation. This is the reason for eroding middle class, we're fed a myth to keep us complacent.

Some of us get lucky by buying a home in a growing market, and outpace inflation that way. Others keep waiting for a perfect moment, afraid of making a mistake, and regret their indecisiveness years later when they compare themselves to their old peers. Ironically, due to inflation, the cost of indecisiveness is actually greater than the cost of making a mistake, because the cost of your mistakes will be washed away by inflation as well.

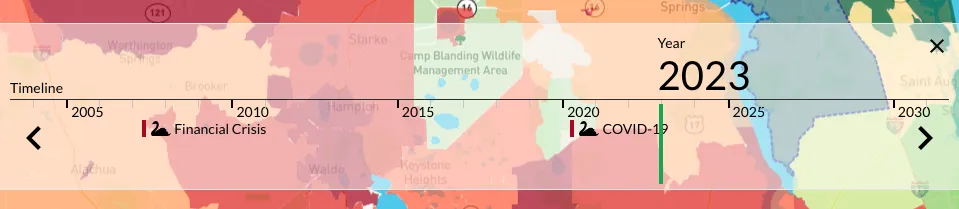

Investomation takes luck out of the equation and empowers you to make good investments over and over, without indecisiveness and without expensive mistakes. For example, you can use the timeline tool (shown below) to see how various cities have fared over time. This tool can be used to see which ones have kept up with the 5% inflation and which ones have been stagnating over the last few decades.

Timeline can be accessed by clicking on the year in the bottom-right corner of Investomation map. You can use the timeline to check data from individual year as well as analyze changes between multiple years. Keep in mind that effects of inflation may not be apparent when looking at a single year, just like with the stock market. Sometimes you'll see median home price stagnant for a few years only to see it increase 15% or more in a single year later, usually to catch up to surrounding areas that have already increased in price.