NFT Use Cases

Over the past year, Non-Fungible Tokens (NFTs) have surged into mainstream awareness. An NFT is essentially a unique digital token on a blockchain that represents ownership of some asset. In early 2021, NFTs made headlines when digital art started selling for jaw-dropping prices. For example, a digital collage by the artist Beeple sold as an NFT for $69 million at a Christie's auction. This frenzy has left many people wondering what exactly are NFTs, and why are people buying JPEGs for the price of a house? In this post, we'll demystify NFTs by explaining what they represent, how they differ from regular cryptocurrencies, how they’re implemented under the hood, and some real use cases beyond the speculation and hype.

Over the past year, Non-Fungible Tokens (NFTs) have surged into mainstream awareness. An NFT is essentially a unique digital token on a blockchain that represents ownership of some asset. In early 2021, NFTs made headlines when digital art started selling for jaw-dropping prices. For example, a digital collage by the artist Beeple sold as an NFT for $69 million at a Christie's auction. This frenzy has left many people wondering what exactly are NFTs, and why are people buying JPEGs for the price of a house? In this post, we'll demystify NFTs by explaining what they represent, how they differ from regular cryptocurrencies, how they’re implemented under the hood, and some real use cases beyond the speculation and hype.

Fungible vs Non-Fungible Tokens

To understand NFTs, we first need to grasp the concept of fungibility. Fungibility refers to an asset’s ability to be exchanged one-for-one with another of the same kind and value. For example, any one US dollar is equivalent to any other dollar, they’re fungible. The same goes for commodities like a barrel of oil or a Bitcoin; one unit is interchangeable with another of equal value. In contrast, non-fungible assets are unique and not directly replaceable by an identical item. Think of things like real estate, art, or collectibles – one baseball card might be worth more or less than another due to its unique attributes, and you wouldn’t simply swap one house for a different house as if they were identical.

NFT stands for Non-Fungible Token, which essentially means it’s a one-of-a-kind digital token. An NFT is a proof of uniqueness and ownership for a specific item. Unlike a Bitcoin (which is fungible and equal in value to any other Bitcoin), each NFT has its own distinct value and properties. In practice, an NFT is a unit of data stored on a blockchain that certifies a digital asset as unique. It’s helpful to think of an NFT as a digital certificate of authenticity or a deed. What’s actually being “owned” is usually a record on the blockchain that points to the asset (for instance, a link to a digital image or media file) and includes metadata about it. The NFT itself contains an ID or serial number and often a reference (like a URL or content hash) to the underlying asset it represents. This means that if you buy an NFT of a piece of artwork, your token’s metadata will indicate “you own token #123 from contract XYZ, which corresponds to this specific artwork file.” The blockchain keeps a public ledger of these tokens, so anyone can verify which wallet holds a given NFT at any time. And since no two NFTs are the same, you truly have something unique, no other token will have the same ID tied to the same asset.

It’s important to note that owning an NFT does not mean the digital image or item itself is magically stored inside the token. Typically, the actual artwork or data is hosted off-chain (on a server or distributed storage like IPFS), and the NFT contains a pointer or hash to that file. In essence, the NFT represents the association between an owner and a unique item. Proponents love NFTs because they provide an immutable, public record of authenticity and ownership for digital goods. Critics, on the other hand, point out that the token is not the content – if the linked file disappears or the hosting service goes down, the NFT may point to nothing. Still, the idea is that rarity and ownership of digital objects can be tracked and traded just like physical collectibles, which is a powerful concept.

Under the Hood: ERC-20 vs. ERC-721 Standards

So how are NFTs actually implemented on the blockchain? The answer lies in token standards. On Ethereum (the platform that popularized NFTs), developers follow standard protocols for creating tokens so that all tokens behave in a predictable way. The two key standards to know here are ERC-20 and ERC-721.

So how are NFTs actually implemented on the blockchain? The answer lies in token standards. On Ethereum (the platform that popularized NFTs), developers follow standard protocols for creating tokens so that all tokens behave in a predictable way. The two key standards to know here are ERC-20 and ERC-721.

ERC-20 is the token standard for fungible tokens, which act like regular cryptocurrencies. If you’ve used Ethereum-based tokens like USDC, Chainlink, or Uniswap’s UNI, you’ve dealt with ERC-20 tokens. All ERC-20 tokens are interchangeable and divisible. Under ERC-20, each token contract maintains a ledger of balances: e.g. Alice has 50 TokenA, Bob has 100 TokenA, and so on. Every token unit is equal, and there’s no built-in notion of uniqueness. This standard defines a common set of functions such as transferring tokens, checking balances, and approving allowances, which wallets and exchanges can interact with. The uniformity of ERC-20 was crucial in the rise of ICOs and DeFi. It meant any new coin following the standard could immediately be supported by existing wallets and trading platforms.

ERC-721, on the other hand, is the standard that made non-fungible tokens possible on Ethereum. Introduced in late 2017 (by the team that created the CryptoKitties game), ERC-721 defines how to create unique token assets. Instead of a balance ledger, an ERC-721 contract keeps track of ownership of distinct tokens, each identified by a unique ID. In simple terms, an ERC-721 token contract might say “Token ID #49214 belongs to Alice, Token ID #49215 belongs to Bob,” etc., rather than saying “Alice has 2 tokens, Bob has 5 tokens.” There is no concept of total interchangeable supply here – each token ID is one-of-one. Because of this, ERC-721 tokens are ideal for representing things like individual artworks, collectibles, or any item where each unit is different. The standard mandates functions like ownerOf(tokenId) to get who owns a particular token, and transferFrom(from, to, tokenId) to transfer a specific token, among others. Just as ERC-20 ensured all fungible tokens speak the same language, ERC-721 ensures all NFTs (non-fungible tokens) follow a common interface for marketplaces and wallets to support them.

Both standards use Ethereum’s smart contracts under the hood, but their data models differ to support these fundamentally different asset types.

Use Cases for NFTs (Beyond Digital Art)

While NFTs first grabbed headlines for outrageous art auctions and collectible JPEGs of apes, the technology has potential far beyond just speculative art trades. Here are some notable use cases for NFTs in mid-2021 that demonstrate their versatility:

While NFTs first grabbed headlines for outrageous art auctions and collectible JPEGs of apes, the technology has potential far beyond just speculative art trades. Here are some notable use cases for NFTs in mid-2021 that demonstrate their versatility:

- Digital Collectibles & Gaming: One of the first big NFT crazes was collectible highlights and trading cards. For example, NBA Top Shot allows fans to buy and trade officially licensed video highlights as NFTs – essentially digital sports cards. At its peak in early 2021, NBA Top Shot generated over $200 million in sales in a single month, indicating huge demand for digital collectibles. Beyond sports, game developers are using NFTs to represent in-game items or characters. A rare sword in a role-playing game or a unique monster in a battle game can be turned into an NFT, so players truly own their item and can trade it or sell it outside the game. This NFT approach to gaming items can even enable play-to-earn models – for instance, the game Axie Infinity lets players earn real income by collecting and selling NFT creatures. Digital collectibles are a natural fit for NFTs because they thrive on the concepts of provable scarcity and ownership.

- Event Ticketing & Membership: NFTs can serve as tamper-proof digital tickets for events or as exclusive membership passes. Because each NFT is unique and traceable, they could eliminate counterfeit tickets and allow easy resale while letting the original issuer earn royalties on resales. We’ve already seen early examples: the rock band Kings of Leon released NFT-based tickets that granted lifetime front-row access to their concerts. An NFT ticket could be scanned at the venue like a QR code, but unlike a traditional ticket stub, it also becomes a collectible in your crypto wallet (perhaps with artwork or perks attached). In the future, event organizers could drop special NFT souvenirs to ticket holders or use NFTs as VIP passes that unlock ongoing benefits (like access to private communities or content) for the token holder.

- Virtual Real Estate & Metaverse Items: As virtual worlds and the “metaverse” concept grow, NFTs are being used to represent ownership of virtual land and goods. Platforms like Decentraland and The Sandbox sell virtual plots of land as NFTs, which users can buy and develop. Owning a piece of digital real estate as an NFT means you can build on it, rent it, or sell it just like physical property (some plots in popular locations have sold for hundreds of thousands of dollars worth of crypto!). Similarly, NFTs can represent items like virtual fashion or accessories for your avatar. This might sound far-fetched, but so did selling virtual swords in games a decade ago – now it’s a thriving economy. NFTs provide a standardized way to establish provenance and ownership of these virtual goods across various platforms.

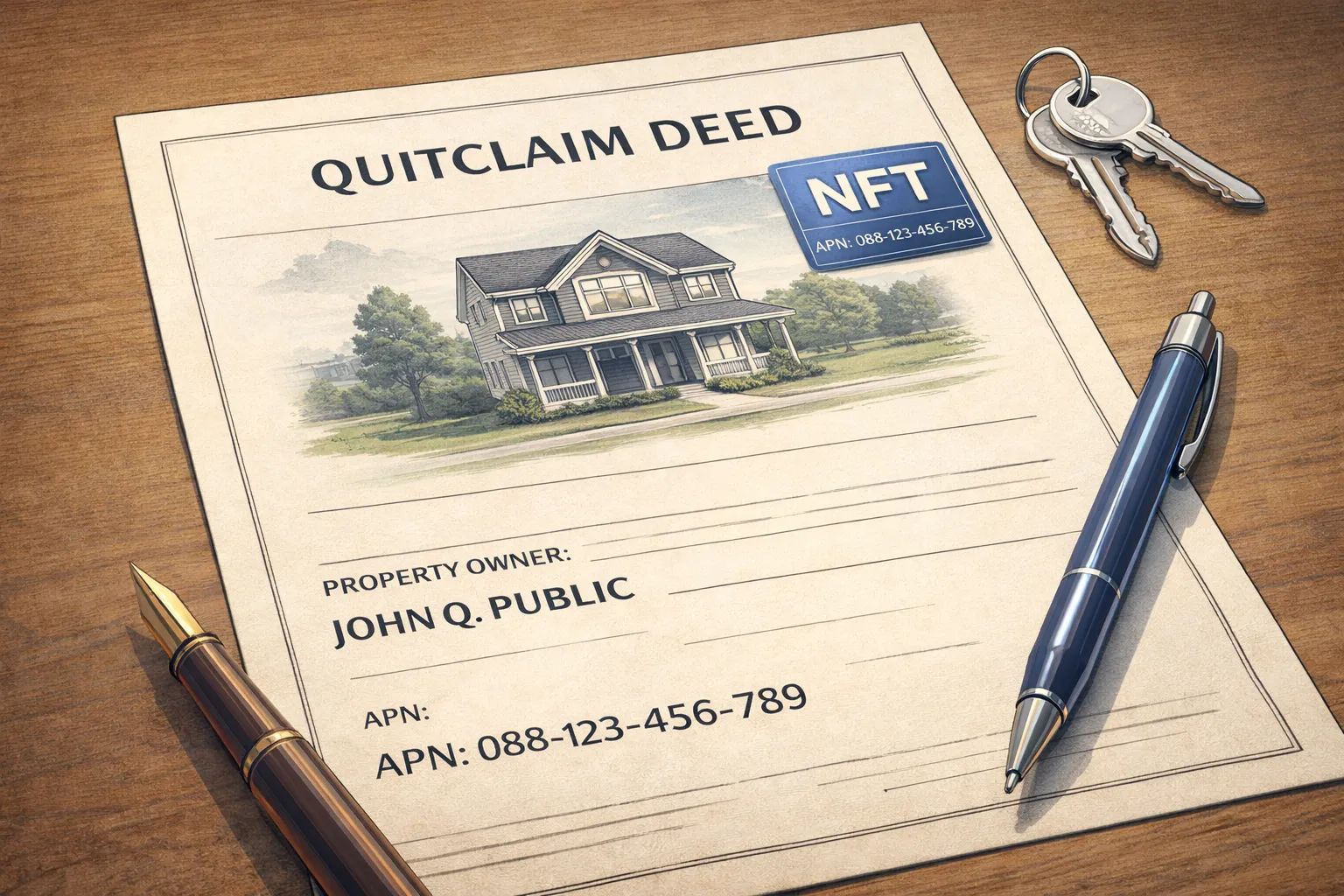

- Real-World Assets and Records: Perhaps the most groundbreaking use of NFTs is tying them to real-world property or legal records. This is still experimental, but it’s actively being explored. In a notable case in 2021, a tech startup facilitated the sale of an actual apartment in Kyiv, Ukraine via an NFT. The NFT was linked to the ownership paperwork, and whoever bought the token became the owner of the property. In theory, anything from real estate deeds to cars or luxury goods could be represented by NFTs to streamline transfer of ownership. Beyond property, NFTs could carry academic credentials, certificates, or identity credentials. Imagine your university diploma or ID issued as an NFT so it can be easily verified as authentic and uniquely yours (no more worrying about fake degrees). These real-world use cases face hurdles (legal recognition, privacy concerns, etc.), but they demonstrate that NFTs aren’t limited to digital art; they can be a general tool for representing ownership of any unique item.

Going Forward

As of mid-2021, NFTs are in a gold-rush phase - attracting artists, collectors, speculators, and tech enthusiasts into a frenzy. We should remember that the underlying idea of NFTs is not about the crazy prices; it’s about digital ownership of unique assets. An NFT can represent virtually anything unique, from a piece of artwork or a video clip to a concert ticket or a property title. The reason NFTs have caused such a stir is that they introduce scarcity and authenticity into the digital realm, where until now copying was trivial and there was often no concept of “original” vs “copy.”

There are certainly challenges ahead. The current implementations (like Ethereum’s ERC-721) have issues like high transaction fees and significant energy usage for minting and trading NFTs. There’s also a lot of confusion among the public about what rights an NFT conveys (buying an NFT of an image doesn’t stop others from sharing that image, it only means you can claim official ownership as recorded on the blockchain). Despite these growing pains, many believe NFTs unlock a new paradigm for content creators and consumers: a world where artists can earn royalties every time their work changes hands, communities can have verifiable ownership in the things they support, and even physical asset transfers can be streamlined. Just as cryptocurrencies are redefining money and finance, non-fungible tokens are redefining how we think about ownership and provenance in a digital world. It’s still early days, but NFTs could very well become an everyday part of how we buy, sell, and experience both digital and physical assets in the years to come.