The Starbucks Effect: What You Need to Know

If you've ever invested in real estate, you know that location is key. One factor that can indicate a good location is the recent opening of a Starbucks. The "Starbucks Effect" is the idea that investing in areas where Starbucks has recently opened can produce above average real estate returns. But why?

If you've ever invested in real estate, you know that location is key. One factor that can indicate a good location is the recent opening of a Starbucks. The "Starbucks Effect" is the idea that investing in areas where Starbucks has recently opened can produce above average real estate returns. But why?

Starbucks does extensive research before opening a new location. They assess population density, income levels, and foot traffic to determine the best areas to open up shop. The factors they track predict gentrification long before other brands see it - a new Starbucks is often the first sign of gentrification.

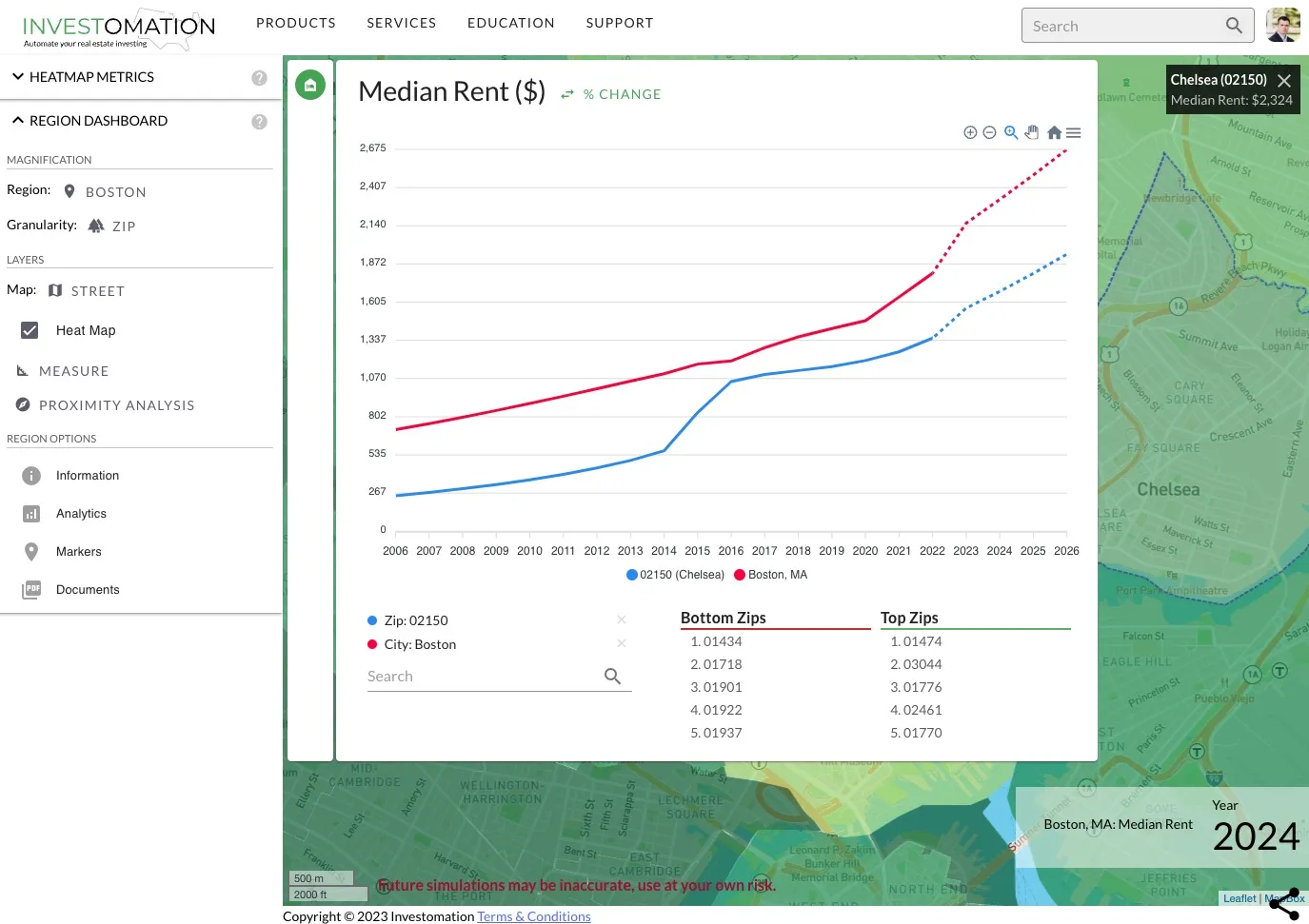

However, believe it or not, mom and pop investors familiar with the area can often see signs of gentrification long before Starbucks can. So can Investomation, because the metrics we webscrape are closely correlated to the ones local investors use. And our statistical analysis can often pick up trends long before the public. For example, I started investing in Chelsea, MA in 2016, after the app alerted me to the rapid rise in rents. Before that I was renting in Newton and knew nothing about Chelsea.

Back then I didn't have the fancy UI you see in this screenshot, but I had enough information to act on that insight. I saw job growth and infratructure improvements. FBI announced that they would be moving their regional headquarters to the city, Silver Line Extension was in process of being built, and crime rates were dropping. I could also see income distribution form a second peak, higher than the original, implying that a new demographic with higher salaries was moving in.

At the time my friends looked at me like I was an idiot. Chelsea was a dump. But I saw potential. It was close to downtown, rents were similar to that of nearby East Boston, and properties cost 30% less. In 2018, the same friends who laughed at me for buying rentals in Chelsea earlier, were now renting there themselves. Some bought condos there, paying a significant premium compared to what I paid just a few years earlier.

And then, in June of 2023, Starbucks opened up a community store just half a mile away from my rental there. Had you waited until Starbucks validated the area, you would have missed out on most of the gains. Don't mimic someone else's investment strategy without understanding it. Invest in your own research tools rather than following the herd. For the cost of 1 coffee/week, you can have access to the same tools I use to analyze markets and get into hot areas several years before institutional investors come in, doubling the cost of your assets in less than 5 years. Sign up for Investomation and start making informed decisions today.

We make the analysis easy for you, we make the data consistent, accounting for differences in reporting methods between various local entities. We search for trends and patterns and alert you when an area makes sense to buy in. We track where people are moving to and where they are moving from. Start analyzing region trends like a pro. Let us help you build your own "Starbucks Effect".