Anchoring: Fixating on Yesterday's Prices

When gentrification hits a neighborhood, it's usually not the people who grew up there that benefit from its success. It's not the lack of information or access to resources. They have front row seats during the neighborhood's redevelopment and access to first-time homebuyer loans that start with 3% down. I'm oversimplifying this a bit since they also need income and a decent credit score - but that shouldn't be a surprise if you want someone to trust you with a $500k+ loan.

When gentrification hits a neighborhood, it's usually not the people who grew up there that benefit from its success. It's not the lack of information or access to resources. They have front row seats during the neighborhood's redevelopment and access to first-time homebuyer loans that start with 3% down. I'm oversimplifying this a bit since they also need income and a decent credit score - but that shouldn't be a surprise if you want someone to trust you with a $500k+ loan.

Aside from procrastination, many people who grew up in the gentrifying area end up missing out on its success because they are anchored to the old prices. Surely it's a rip-off to pay $500k for a property that sold for $100k less than a decade ago. We're all guilty of anchoring - myself included.

Case Study: Missing Out on a Deal

When I was just getting started in 2015, I was laser-focused on my buy box:

[!info] Buy Box

- Triplex in Chelsea

- Under $500k

- Meets 1% rule (rent/price ratio > 1%)

Finding a property that fit this buy box wasn't too difficult, but many of them had issues. Decent properties did come up from time to time but were often asking a little above my buy box. As I continued sitting on the sidelines analyzing, I noticed the prices creeping up. Deals became less frequent and I eventually had to pull the trigger to avoid getting priced out of the market.

I'm glad I did, this property is still part of my portfolio and brings $2,500/mo today. However, it's the ugly duckling of my portfolio. It doesn't have good bones, it doesn't have much room, it doesn't have parking. Most properties I dismissed initially would have made better rentals despite not fitting into my buy box. Had I "overpaid" another $50k for a better deal then, I could have easily saved myself hundreds of thousands in repair costs, tenant issues, and appreciation. Rising tide lifts all ships, the cost of overpaying for a property (especially if you buy in a good market) doesn't matter in the long run. A $10,000 price increase translates to $50/mo payment - a worthwhile investment for peace of mind of locking in a great asset. What matters is getting into the game, and staying in the game.

I was too anchored on the price and ultimately had to sacrifice quality. This sacrifice in quality created a bad taste in my mouth. For the first 2 years, I struggled in real estate. I had constant issues with repairs and tenants. Had I paid a little more, I would have saved on repairs and attracted a better tenant immediately. This in turn would have allowed me to focus on my next acquisition rather than fixing issues with my first one. As Warren Buffett puts it - "it's better to buy a great business at a good price than a good business at a great price".

New Reality

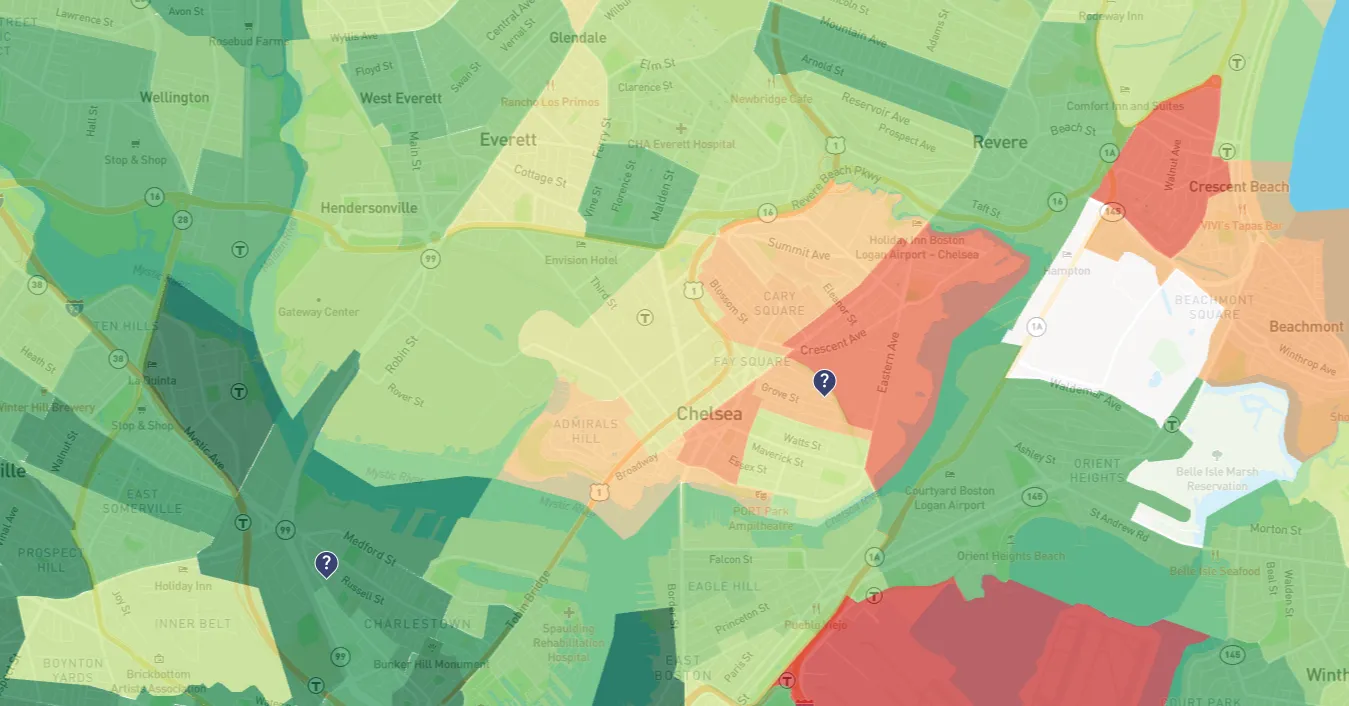

I'm not upset that I bought the above rental. The worst choice would have been just to sit on the sidelines, which is exactly what many of us do when our hometown is appreciating. We dismiss rising prices as a bubble, until a new reality sets in and we realize that we've been priced out of our own hometown. It didn't happen overnight, it took years. The changes were subtle, gradual: less crime, less noise, less trash. You took them for granted. New investors did not. They were willing to offer a premium for the benefits you failed to appreciate. Your price is anchored to the past, their price is anchored to the present price of surrounding regions.

They did their homework, they understand your area's potential, and they don't look at it in a vacuum. They're willing to overpay today to take advantage of tomorrow's opportunities.

They did their homework, they understand your area's potential, and they don't look at it in a vacuum. They're willing to overpay today to take advantage of tomorrow's opportunities.

As the age-old adage goes: the best time to invest was yesterday, the second best time is now. If you missed yesterday's opportunity, don't wait for it to come back. It probably never will. Don't beat yourself up about it either, take advantage of the opportunities you have today. Use the past as a lesson, not as an anchor.

Anchoring works both ways. The same force that keeps others stuck in the past presents developers with an opportunity to purchase at a discount from the neighbors. Existing owners sell their properties for less because they're anchored to the old prices. One owner may choose to sell at a discount to avoid the headaches of fixing the property up, another may expect a price similar to recent sales without making the property improvements to justify the new price. Such impasse is common between wholesalers and "motivated sellers". Negotiation is what wholesalers collect their premium for. It takes time to explain the new reality to the seller, it takes time for them to listen. It took me time to realize that sometimes it's worth to pay an extra $50k to lock-in today's price.