Differences Between A/B/C/D Neighborhoods

You've probably heard other real estate investors refer to neighborhoods as A-class or C-class, but what do these labels mean? I've already discussed these in a recent YouTube video but I figured I would also dedicate a blog post to it, for those who may not watch YouTube. Basically, neighborhoods can be broken down into 4 classes based on their desirability.

You've probably heard other real estate investors refer to neighborhoods as A-class or C-class, but what do these labels mean? I've already discussed these in a recent YouTube video but I figured I would also dedicate a blog post to it, for those who may not watch YouTube. Basically, neighborhoods can be broken down into 4 classes based on their desirability.

2024 Update: I've added some images to this post to help illustrate what the typical vibe of each neighborhood feels like. One thing to note is that the density of the neighborhood isn't necessarily tied to the class, an A-class neighborhood could be a sprawling suburb or a luxurious downtown high-rise. The same goes for the other classes, although poorer areas do tend to be more densely populated due to the lower cost of living.

Class A

Class A neighborhoods are characterized by a predominantly white-collar tenant-base. These tenants rent for convenience rather than out of need. They don't want to deal with home ownership headaches or they realize it may be cheaper to rent than to buy in the area they want to live in (because rents always lag home prices). A-class areas will often have great schools, parks and ammenities. There is virtually no crime or property damage in A-class neighborhoods and these are great places to park your wealth if you don't care about cashflow. Most of the homes here are owner-occupied, which means that you'll have to compete with emotional buyers willing to overpay for a home. Most houses in these areas will be single-family.

Class A neighborhoods are characterized by a predominantly white-collar tenant-base. These tenants rent for convenience rather than out of need. They don't want to deal with home ownership headaches or they realize it may be cheaper to rent than to buy in the area they want to live in (because rents always lag home prices). A-class areas will often have great schools, parks and ammenities. There is virtually no crime or property damage in A-class neighborhoods and these are great places to park your wealth if you don't care about cashflow. Most of the homes here are owner-occupied, which means that you'll have to compete with emotional buyers willing to overpay for a home. Most houses in these areas will be single-family.

As you might have already guessed, cashflow in these areas is quite poor, often negative (your mortgage + expenses is higher than rent). Examples of Class A neighborhoods include Newton, MA, Beverly Hills in Los Angeles, CA, Upper East Side in New York, NY, and Pacific Heights in San Francisco, CA, and Plano, TX. A-class areas tend to be the first to appreciate if the city is growing and the last to lose value if the city is losing population. A-class areas hold their value well in a recession since most tenants here are not living paycheck to paycheck and most owners here won't get foreclosed on. However, even these areas are not immune to demographic shifts and blackswan events, as many Manhattan landlords found out in 2020. These are the real-estate equivalent of blue chip stocks (plus the typical real estate upkeep cost).

Class B

Class B neighborhoods are typically blue-collar/working-class areas, with tenants who may not have the financial means to buy a home. Rent and home prices in these areas are typically more affordable than in Class A neighborhoods, and schools are still decent. Most of the typical suburbs fall in this category, and these are probably the safest places to start investing in. You know you'll be able to find a good tenant here who can afford the rent, and unless the city as a whole is losing population or decides to open a homeless shelter nearby, these areas aren't going to lose value. B-class areas tend to have the lowest vacancy rates, which means that you can be picky about tenants.

Class B neighborhoods are typically blue-collar/working-class areas, with tenants who may not have the financial means to buy a home. Rent and home prices in these areas are typically more affordable than in Class A neighborhoods, and schools are still decent. Most of the typical suburbs fall in this category, and these are probably the safest places to start investing in. You know you'll be able to find a good tenant here who can afford the rent, and unless the city as a whole is losing population or decides to open a homeless shelter nearby, these areas aren't going to lose value. B-class areas tend to have the lowest vacancy rates, which means that you can be picky about tenants.

While A-class areas are the first to appreciate when the city grows, it is B-class areas that that benefit more long-term, as new home buyers who were priced out of A-class areas flock into these neighborhoods. It's not uncommon for B-class areas to mature into A-class as the owners age and accumulate more wealth. We've seen this happen with Allston and Watertown in Boston.

Other examples of Class B neighborhoods include Waltham in Boston, MA, Pasadena in Los Angeles, CA, and Highwood in Chicago, IL, Katy in Houston, TX and McKinney in Dallas, TX. In large cities, it's not uncommon to find B-class neighborhoods unable to cashflow. The fact that most housing stock here, as with A-class, tends to be single-family doesn't help either, since it's easier to be net-positive with a multi-family property.

Class C

Class C neighborhoods are blue-collar/no-collar areas, predominantly occupied by tenants who live paycheck to paycheck. Rents will be lower here, but so will the house prices. The fact that many properties here will be multi-family will further help with cashflow. The downside is all the extra headaches that come with managing these properties. You will likely see significantly higher property damage and crime, may have to evict tenants for non-payment, deal with disruptive tenants and will need much more vigilant property management. You will likely see a lot of subsidized tenants here.

Class C neighborhoods are blue-collar/no-collar areas, predominantly occupied by tenants who live paycheck to paycheck. Rents will be lower here, but so will the house prices. The fact that many properties here will be multi-family will further help with cashflow. The downside is all the extra headaches that come with managing these properties. You will likely see significantly higher property damage and crime, may have to evict tenants for non-payment, deal with disruptive tenants and will need much more vigilant property management. You will likely see a lot of subsidized tenants here.

Be extra careful when doing your background checks, my personal advice is to deny anyone with a credit score below 675. How well the tenant pays their credit card is a good indicator of how well they'll pay rent. Don't buy their sob-story. In states like Massachusetts, credit score is one of the only remaining ways to deny housing to a potentially bad tenant without being accused of discrimination, and they're trying to change that too (one of the many reasons to avoid investing in Massachusetts).

Schools in C-class areas will be bad, parks may have bums in them, and you're more likely to see a McDonalds than a Starbucks. The streets here will be dirty with garbage because some residents think it's cool to litter. Trying to call them out on it is futile, they'll claim that they're exercising their freedoms... because the best display of freedom in their opinion is to shit in their own backyard.

Good examples of C-class areas are Chelsea, MA, Roxbury in Boston, East Los Angeles in CA, the South Side of Chicago, IL, South Bronx in New York, NY, the West Side of Detroit, MI, and the North Side of Baltimore, MD. C-class areas typically don't appreciate well unless the city is growing, but even then, the locals see gentrification as some sort of disease that needs to be fought, oblivious to other quality of life improvements it brings.

Class D

D-class neighborhoods are areas that have been severely impacted by crime, poverty, and other social issues. These neighborhoods are often referred to as war zones. You should not be investing in D-class remotely, in fact I'm of the opinion that you shouldn't even be investing in these areas if you're local. They require good knowledge of the area and strong local ties. It's not uncommon to see your property damaged in turf wars or hear about someone getting shot 2 streets away... every week.

D-class neighborhoods are areas that have been severely impacted by crime, poverty, and other social issues. These neighborhoods are often referred to as war zones. You should not be investing in D-class remotely, in fact I'm of the opinion that you shouldn't even be investing in these areas if you're local. They require good knowledge of the area and strong local ties. It's not uncommon to see your property damaged in turf wars or hear about someone getting shot 2 streets away... every week.

These areas are often characterized by high crime rates, abandoned buildings, and a general sense of danger. Examples of war zone neighborhoods include Englewood in Chicago, IL, South Central in Los Angeles, CA, the East Side of Cleveland, OH, parts of Baltimore, MD, and many neighborhoods in Detroit, MI.

These classifications are generalizations - there's variation within each class. The same neighborhood might be classified differently depending on who you ask. And some cities are significantly safer than others overall. I would say I don't even know of a D-class area near Boston, whereas I can name quite a few in Chicago.

Property Condition

Investors will often apply the same ranking critera to individual properties:

- A-class: new construction, high-quality materials

- B-class: somewhat dated but well-kept, decent materials, good bones

- C-class: dated property that has not been maintained, may have mold, rot, and pests

- D-class: how do people even live here?

While there is often correlation between the neighborhood class and the property class, they are not the same. An A-class property is more common in A-class area for the sole reason that people who can afford to live in a better area can also afford new construction and better quality finishes. But that doesn't mean that every property in an A-class neighborhood is A-class. In fact, many real estate investors focus on finding C/D-class properties in A-class areas and turning them into A-class for a new buyer, that's exactly what flipping is.

How to Quickly Identify Neighborhood Class

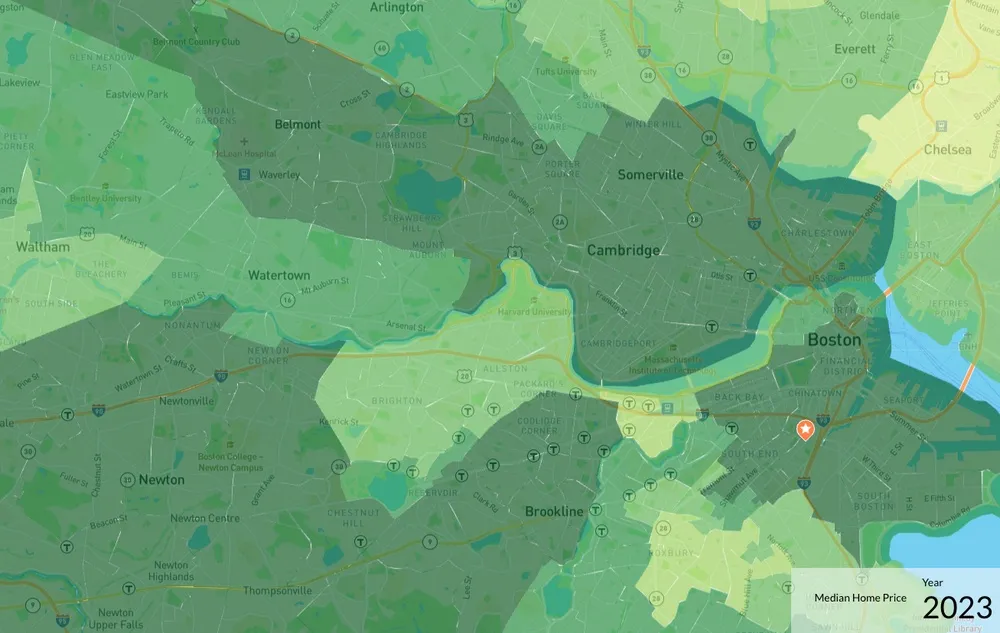

If you're local, you can probably tell the class of a neighborhood just by driving through it. Of course there are a lot of intangibles that you won't immediatelly see, such as median income or school quality. You can usually find those metrics online. If you want to save yourself some time, feel free to use our map, which will save you hours (if not days) of time on research. Just plug in the metrics mentioned above (income, crime rate, poverty, education, etc.) and you will see a heatmap similar to the one in the screenshot at the top of this post.