The Rise and Fall of Harmony Network

In the summer of 2019, a new blockchain quietly went live. Harmony’s mainnet launched in June, without much fanfare, influencer hype, or yield farming theatrics. Its claim was bold but oddly understated: Harmony was what Ethereum was trying to become, already. Sharded, proof-of-stake, fast, and cheap. Not a roadmap. Not a promise. A working system.

In the summer of 2019, a new blockchain quietly went live. Harmony’s mainnet launched in June, without much fanfare, influencer hype, or yield farming theatrics. Its claim was bold but oddly understated: Harmony was what Ethereum was trying to become, already. Sharded, proof-of-stake, fast, and cheap. Not a roadmap. Not a promise. A working system.

At the time, Ethereum was still choking on its own success. Every DeFi transaction on Ethereum was the equivalent of sending a traditional wire: $25+ gas fees and 8+ clearing times. Harmony offered something radically different. Transactions cleared in roughly two seconds. Fees were so small they barely registered. The roadmap even included one-second finality. The technology worked, and it worked smoothly.

What made Harmony genuinely interesting was not just speed or cost, but how it achieved them. Harmony approached scaling differently. Instead of requiring every validator in the network to agree on every transaction, it split the blockchain into shards that acted like local governments. Each shard handled its own transactions, following the same laws as the rest of the network, but without waiting for universal approval. Validators were regularly reassigned between shards, preventing any one group from gaining long-term control. The result was a system where decisions were made locally, security was enforced globally, and the network could grow without turning into a bureaucratic bottleneck.

The team’s whitepaper laid this out clearly. Harmony combined adaptive state sharding, fast Byzantine fault tolerant consensus, and verifiable randomness to assign validators across shards securely. In simpler terms, it solved two problems most blockchains struggled with at the same time: scaling without centralization, and speed without sacrificing security. It was an elegant solution to the Blockchain Trilemma. And yet, initially, almost no one cared.

While Binance Smart Chain and later Polygon were pulling in users with incentives and copy-paste DeFi protocols, Harmony was mostly empty. Ethereum’s DeFi ecosystem remained active despite punishing gas fees, simply because that was where the liquidity already lived. From the outside, Harmony looked like a ghost town. But for the people who did show up, that emptiness was the point.

Harmony became a sandbox. A quiet place to experiment with DeFi without bots front-running every trade, without constant rug pulls, without meme tokens flooding the ecosystem every hour. You could deploy contracts, test ideas, and interact with protocols without feeling like prey. It felt safe. It felt civil. It felt like early Ethereum, before the chaos.

Bridges & Inclusion: A Universal DeFi Highway

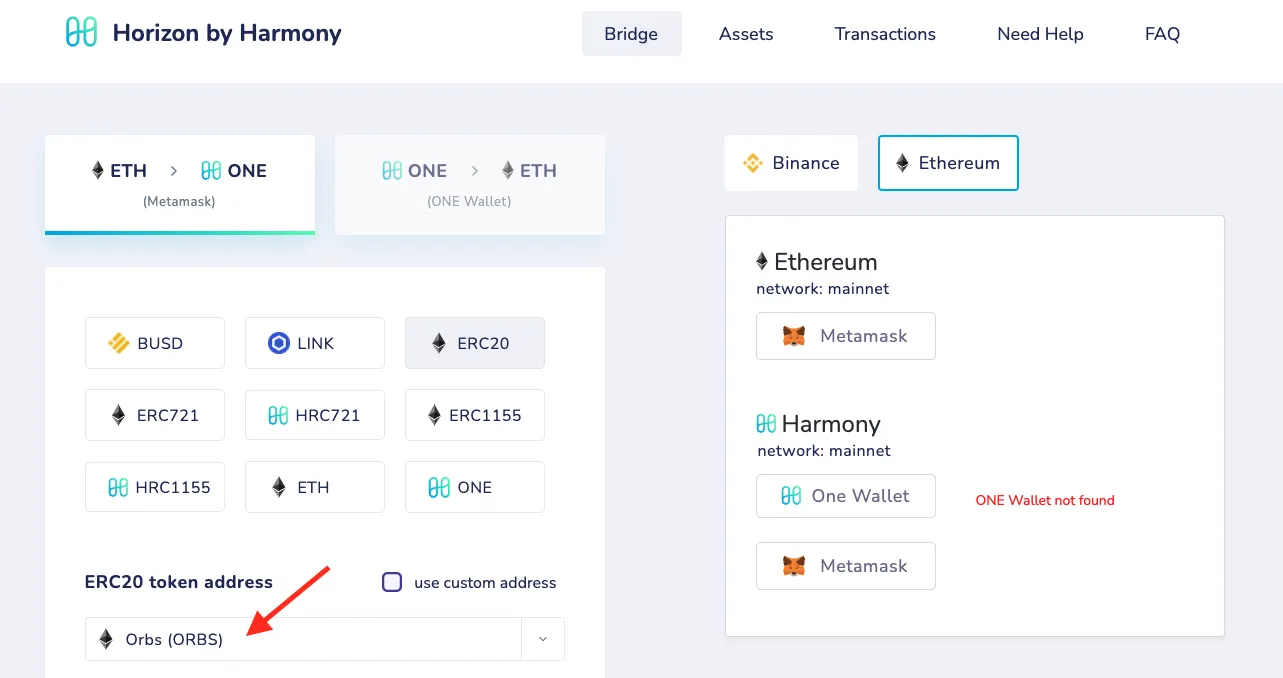

Harmony’s big pitch was interoperability. In late 2020 the team unveiled Horizon Bridge, a two-way bridge linking Harmony with Ethereum and Binance Smart Chain. Overnight, ERC-20 tokens, stablecoins, and even NFTs could “flow” into Harmony.

Harmony’s big pitch was interoperability. In late 2020 the team unveiled Horizon Bridge, a two-way bridge linking Harmony with Ethereum and Binance Smart Chain. Overnight, ERC-20 tokens, stablecoins, and even NFTs could “flow” into Harmony.

The bridge was effectively a multi-chain docking mechanism that could in theory work on any Solidity-powered DeFi network. Initially only deployed on Ethereum and Binance Smart Chain, with plans to deploy to other chains later. To use the bridge, the investor would need to lock-up their assets on the network from which the asset originates in order to mint the equivalent amount of wrapped asset on the Harmony network. The original asset would effectively "dock" at the bridge, unlocking a "virtual" version of the same asset on Harmony network.

But why would one want a bridge to Harmony network? Low fees! Anyone could now participate in DeFi without being priced out. No longer just whales, but every wallet could play. To drive this, Harmony even teamed up with Terra (and the Cosmos ecosystem). By late 2021 they completed a bridge for Terra’s UST stablecoin and announced broad “full-stack” partnerships. Harmony was positioning itself as a universal cross-chain hub – the cheap, fast highway connecting blockchains.

Harmony's Early DeFi History

Harmony’s early DeFi ecosystem did not arrive with fireworks. It arrived with clones. The first notable application on Harmony was ViperSwap, a Uniswap fork adapted to the chain. It worked, it was fast, and it was cheap, but it was also familiar. For a long time, Harmony’s DeFi landscape looked like a graveyard of copy-paste experiments. One Uniswap clone after another. Slightly different tokenomics. Slightly different incentives. Very little real activity.

For months, nothing meaningful happened. This wasn’t a failure so much as a reality check. Liquidity does not move just because technology is better. Ethereum remained congested and expensive, yet it still dominated because that was where capital already lived. Binance Smart Chain attracted users with incentives. Polygon followed a similar path. Harmony, by contrast, was quiet.

There were a few genuinely native applications. DaVinci, Harmony’s NFT marketplace, stood out early as a polished, purpose-built product rather than a fork. It gave artists and collectors a place to mint and trade NFTs without paying Ethereum-level fees. There were also small on-chain games and experiments. CryptoRoyale, a browser-based game that rewarded players with tokens, gained a cult following and quietly demonstrated what low fees made possible. But none of this translated into serious DeFi liquidity. Harmony remained a sandbox. Interesting, functional, but largely ignored.

Rise of DeFi Kingdoms

DeFi Kingdoms started off as just another Uniswap clone. There was no game, no NFTs, just another DEX (Decentralized Exchange) minting tokens, luring in

DeFi Kingdoms started off as just another Uniswap clone. There was no game, no NFTs, just another DEX (Decentralized Exchange) minting tokens, luring in degens investors in with astronomical yields. The playbook was familiar: come in early to provide liquidity and enjoy the high yields, unlock after a few weeks (while the yields are still high enough to lure in new suckers) and leave with new assets and relatively little losses. This was tried and true strategy battle-tested in ViperSwap and several other clones.

But this time something was different. The team actually started innovating, they promised rewards, like early access to their NFTs to those who remained in the pools longer, they added mechanisms to burn tokens. NFTs eventually turned into game characters, the game spawned its own economy. One dangling carrot after another, they actually lured investors in. These guys understood incentives, they understood marketing.

DeFi Kingdoms was not just another DEX. It was a full-fledged on-chain game built around liquidity provision, yield farming, NFTs, and gamified progression. It took familiar DeFi primitives and wrapped them in a world that made sense to users who did not care about DeFi jargon.

Liquidity flooded in. Users from Ethereum, Binance Smart Chain, and Polygon showed up almost overnight. For the first time, people outside the Harmony were paying attention. Those who entered DeFi Kingdoms early watched their positions balloon into seven figures on paper. Many were sitting on millions in unrealized gains - most of it locked. The lockups were long. Often a year or more. It was a feature that aligned incentives. It discouraged mercenary capital. DeFi Kingdoms put Harmony on the map.

The Catastrophe: Horizon Bridge Exploit

On June 23–24 of 2022, North Korean-linked hackers (the Lazarus Group) exploited the bridge and stole almost $100 million by undocking the underlying assets locked the the bridge using a set of keys they stole. The value of all bridged assets representing the now undocked assets on the Harmony network went to zero. The very feature that powered Harmony’s growth became a single point of failure. Over 65,000 wallets were affected as ETH, BNB, USDC, USDT and other tokens streamed out to hackers. Analysts traced the funds through mixers and quickly confirmed Lazarus was behind it.

The immediate fallout was brutal. Stablecoins (USDC, USDT) that people had brought onto Harmony completely de-pegged and cratered in value. ETH and wrapped BNB on Harmony were no longer backed. Protocols like Aave, which had launched on Harmony, suddenly held “ghost” collateral. Opportunistic arbitrageurs flooded in: they deposited now-unbacked USDC/USDT, borrowed ONE or LINK, and dumped them – leaving lenders with bad debt. In effect, even investors who thought they were “just” holding ONE or other native tokens saw their positions wrecked. Many investors lost over $200,000 worth of assets that they thought were safe. They kept their money in stablecoins, thinking they were safe in preparation for the upcoming crypto winter. What they failed to account for was the risk imposed on these assets by the network itself.

Blunders and Betrayals: Security Lapses Exposed

As the hack reverberated, more bad news followed. Harmony’s own post-mortem revealed a litany of preventable mistakes. The attackers had literally tricked a developer into installing malware on June 17, then probed Harmony’s private cloud on June 18. Harmony's basic security was lax. With compromised laptops and exposed server addresses, hackers quietly gathered enough keys to withdraw the bridge funds. The community was livid. On Harmony’s forums, users scolded the team - “would have loved to see these best security practices in place before handling $100M,” one wrote. Indeed, a properly multi-sig’d, audited setup should have prevented a single compromised signer from draining everything. Instead, poor OpSec and missing safeguards meant the entire chain’s liquidity disappeared in hours.

After the hack, Harmony scrambled to rebuild trust. The bridge was halted, new keysets were added, and the team formed a “Security Ops” group to overhaul cloud practices. But the initial damage was done: confidence evaporated. Many investors felt betrayed – not just by the bridge exploit, but by the revelations that the Harmony team had essentially given away a $100M treasury to hackers due to negligence.

“Printing” Money and the Community’s Fury

In the panic, Harmony’s developers proposed “solutions.” On July 27, 2022 they unveiled a radical plan: to reimburse victims, mint billions of new ONE tokens (via a hard fork) rather than spend the treasury. Two options were floated:

- Option 1: Compensate victims 100% of losses by minting 4.97 billion new ONE (about a 38% increase in total supply).

- Option 2: Compensate 50% of losses by minting 2.48 billion new ONE.

Both plans would drip-feed new tokens to victims over three years to “prevent market chaos,” but either way the supply would swell dramatically. Harmony’s blog argued this was better than bleeding the treasury, but the community was enraged. Holders correctly pointed out that printing billions of coins to pay off a hack was just going to crash ONE’s price and punish everyone else. Many said flatly that inflating away their losses was worse than leaving the bridges dead.

The uproar was intense. Ultimately, Harmony shelved the massive mint plan amid the backlash. The damage was done, ONE’s liquidity was decimated. The chain’s total value locked had collapsed from a $1.42 billion peak to under $28 million – a ~99.8% wipeout. DeFi Kingdoms’ JEWEL token fell over 99% from its high (some DeFi Kingdoms liquidity was moved to Avalanche with the launch of the expansion). Thousands of investors were left nursing six‑figure losses and shaking their heads.

Lessons and the Road Ahead

Harmony’s saga offers sobering lessons for DeFi. Interoperability and high throughput are powerful, but they require bulletproof security. The hack showed that bridging assets onto a chain concentrated protocol risk: whatever you diversified away from (e.g. Ethereum’s congestion fees) you exposed yourself to (the bridge’s vulnerability). As one analyst put it, even a giant like Aave wound up mired in this fiasco and had to propose its own fixes, simply because it relied on Harmony’s insecure bridge.