How to Lose Money in Real Estate

As someone who's always looking to expand my real estate portfolio, I get daily emails from brokers/wholesalers with real estate deals. Most of them are not actually deals, but disguised to appear as such through fudged pro-forma numbers. What do I mean by that? Well, let's take a look at a recent deal that appeared in my inbox.

As someone who's always looking to expand my real estate portfolio, I get daily emails from brokers/wholesalers with real estate deals. Most of them are not actually deals, but disguised to appear as such through fudged pro-forma numbers. What do I mean by that? Well, let's take a look at a recent deal that appeared in my inbox.

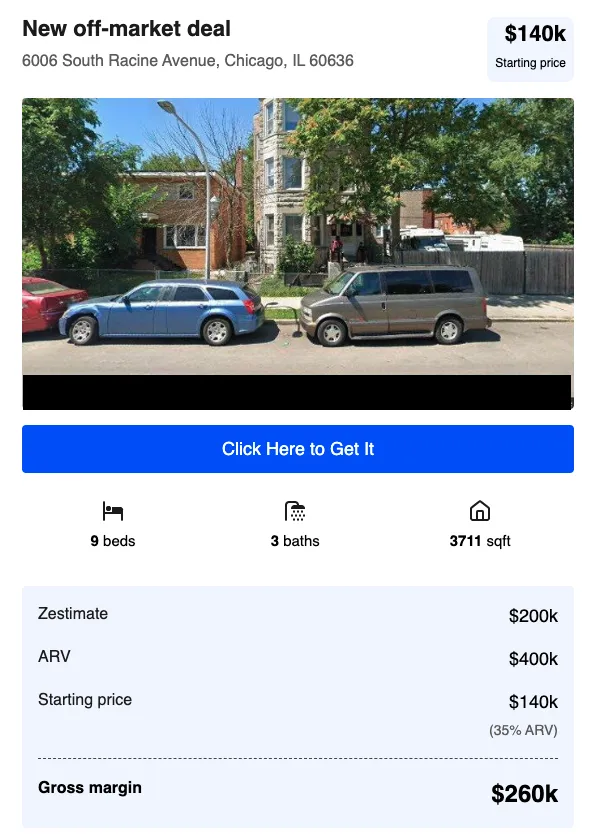

This is a deal in Chicago inner city, close to downtown. The deal packet even included several comps from nearby zipcodes to justify their $400k ARV (after-repair value). If those numbers are true, this is a fantastic deal. You're snatching up a brownstone triplex for less than half of what it's worth. Even if we budget $100k for renovations, we should still come out ahead. Right?

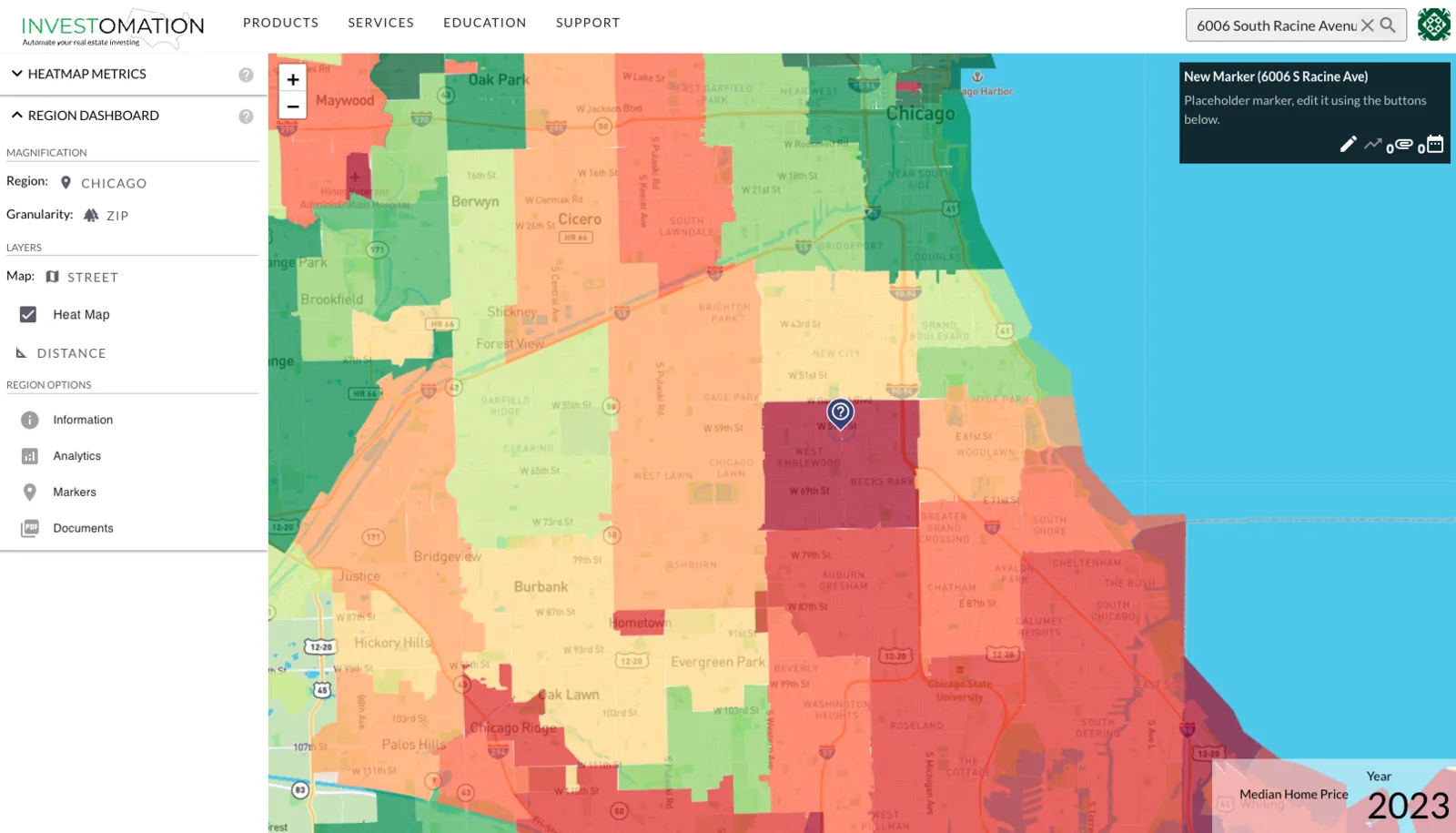

The problem is that this wholesaler (whose name I've omitted) is lying about the ARV and using bad comps to hide this. If I search for this address on the Investomation map, I get a very different picture:

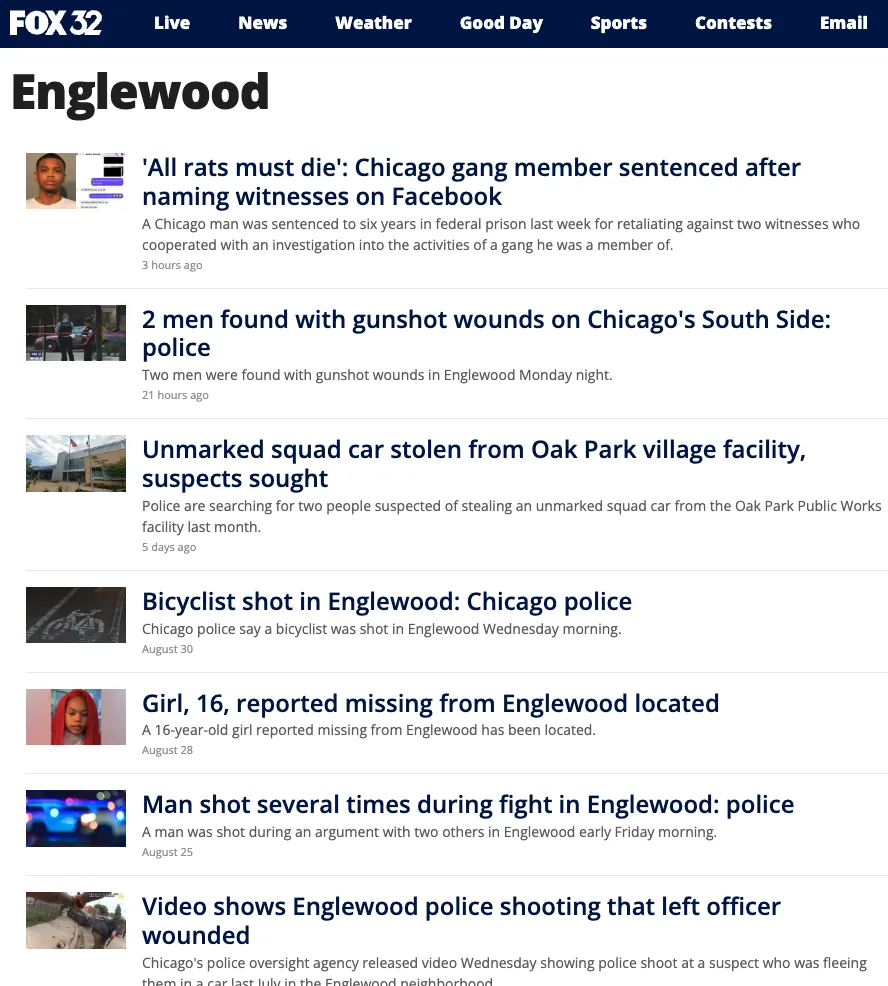

This property is right in the middle of Englewood, one of the worst parts of Chicago (as indicated by the Investomation heatmap). Englewood is known for its high crime rate, poverty, and unemployment. Shootings are routine, and the area is known for its gang activity. Over the labor day weekend there were 42 shootings. List of recent crimes in Englewood can be found on the FOX32 website, there are at least 2 shootings per week:

Englewood is a textbook example of a warzone neighborhood, one that investors should avoid at all costs. Over 30% of the buildings in Englewood are vacant (a metric also tracked by Investomation), these houses don't sell. What this wholesaler did is use comps from nearby zip codes with lower crime and higher ARVs. While these comps are physically close, those areas are very different in character - something that's not obvious if you're unfamiliar with the area. Chicago area changes block by block (same is true of many other cities, like Philadelphia).

Back in 2015 when I was buying rentals in Chicago, I spoke to another investor who had over 100 units in South Chicago. The two areas he wouldn't touch were Englewood and Roseland. He even told me a story about a brick bungalow he bought for $20k there (thinking it was a steal). The house got vandalized a week after his team finished renovations. He came to see shattered windows and front door kicked in. All appliances were stolen. On his newly painted walls in the living room he saw spray paint. The words said "go home, white boy". He took their advice and left the house as-is, without even trying to sell it. This particular neighborhood decided to fight gentrification with violence and vandalism.

This is also why I'm not a fan of turn-key companies. They often target D-class areas, buy distressed properties in bulk for pennies on the dollar, renovate them, and sell them to out-of-state investors, putting subpar property management in place. Then they repeat the same strategy in a different market, while their investors are stuck holding a property they can't sell.