How To Analyze Self-Storage Demand (Part 2)

In my previous blog post I spoke about the factors affecting demand for self-storage. This is a continuation of that post, focusing on quickly doing some of that research using Investomation and freely available tools.

In my previous blog post I spoke about the factors affecting demand for self-storage. This is a continuation of that post, focusing on quickly doing some of that research using Investomation and freely available tools.

Recently a deal came across my desk for a warehouse in a rural town in Georgia. It's not quite self-storage but can be converted to one for a relatively low cost. Initially the numbers on it seemed really good, but after doing my analysis, I may have to pass on it. I'm going to use this as an example to show you how to do a quick demand study.

The Deal

Price: $399,000

Size: 26,000 sqft

Configuration: 2 warehouses (10,000 sqft space and 16,000 sqft)

Tenants: 1 warehouse occupied at $1,750/mo, one vacant

Condition: A bit run-down, rusted roof, used to be a farm

Land: 11 acres

At $15/sqft, this deal seems like a steal. For reference, cost of self-storage construction today is $50-60/sqft (not counting the cost of land). Even portable storage solutions cost $28/sqft plus delivery and assembly fees. Not to mention 11 acres of land it sits on that can be used for addditional expansion. You rarely see deals like this in the self-storage industry. But before we get too excited, let's do a demand study as outlined in the previous article.

Demand Study

We'll go through the bullets in the previous article, but since this is meant as an initial study, we'll start with the factors that take the least time to check and skip over the time-consuming parts, saving them for the due diligence phase. Remember, our goal is to minimize the time spent analyzing bad deals, not to do a full analysis on every deal that comes across our desk.

In this example I will use Investomation's Proximity Analysis tool to make this research easy, but you can also use population data from Census directly. Keep in mind that Census will group the data by zip code, and since zip codes don't happen to be perfect 3-mile circles centered around your parcel of land, you may have to do a lot more math to get accurate information.

Square Footage Per Capita

A market in equilibrium has 8 sqft/person of storage space. I prefer to buy in markets with 6 sqft/person or less for an added margin of safety because if there is one thing I learned it's that no matter how good my estimates are, there will always be something I missed.

To find existing storage/capita, we need to look at nearby self-storage facilities and population within a few miles of our location. In a typical suburban area, we should do our analysis within a 3-mile radius of our facility. If we're in a densely urban area, the radius can be as low as 1 mile. In rural areas, we can expand the radius to 5 miles. For our example we'll use a generous 5-mile radius, assuming that people in a rural market are more comfortable with a longer drive.

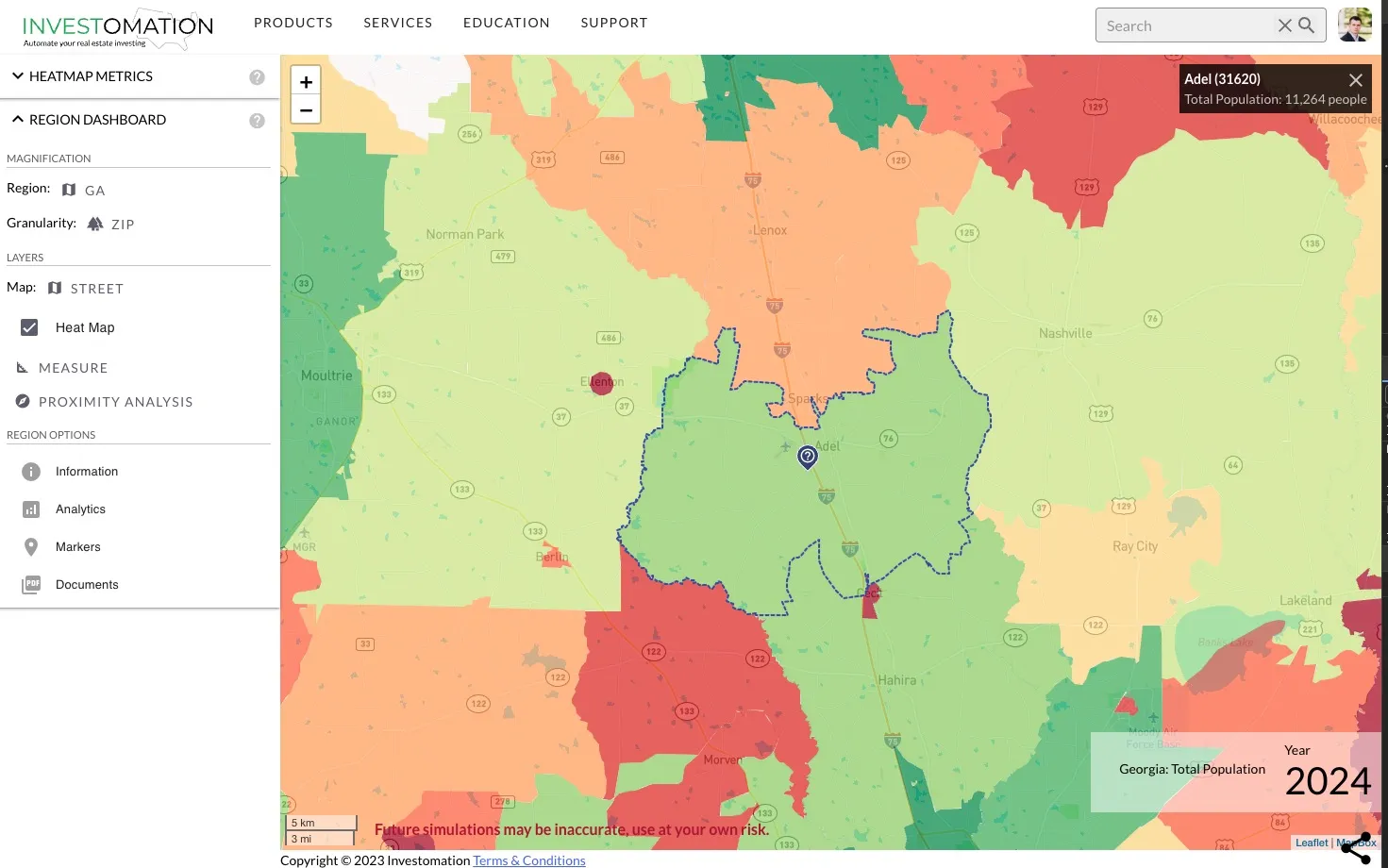

We'll use Investomation to do this analysis. First, we'll load up the analytics map, and search for the property address. We should automatically zoom in to the region where our property is located. We then select Total Population metric from Heatmap Metrics menu and hit Compute button. We should now see a heatmap of the population in the area.

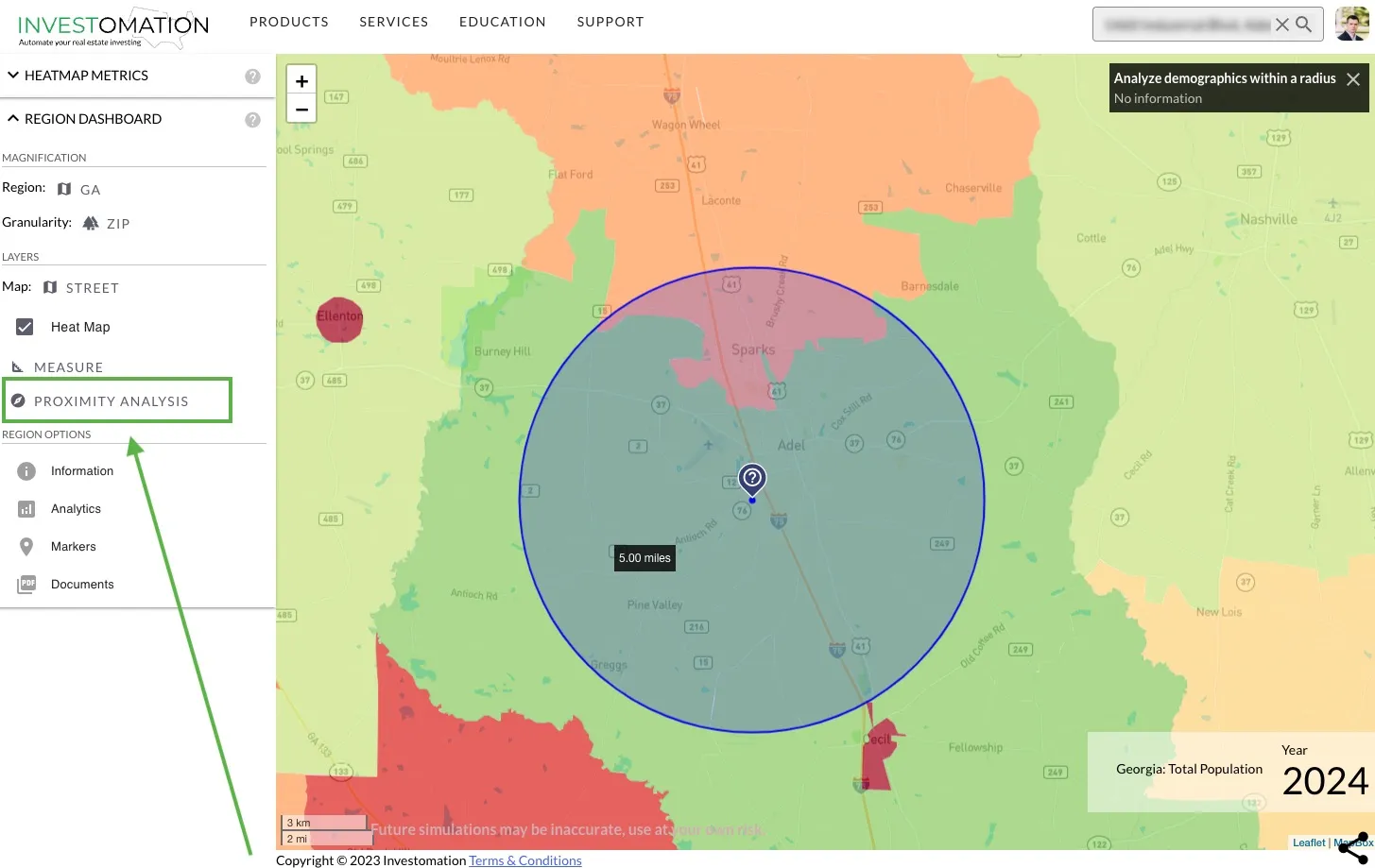

Then, from

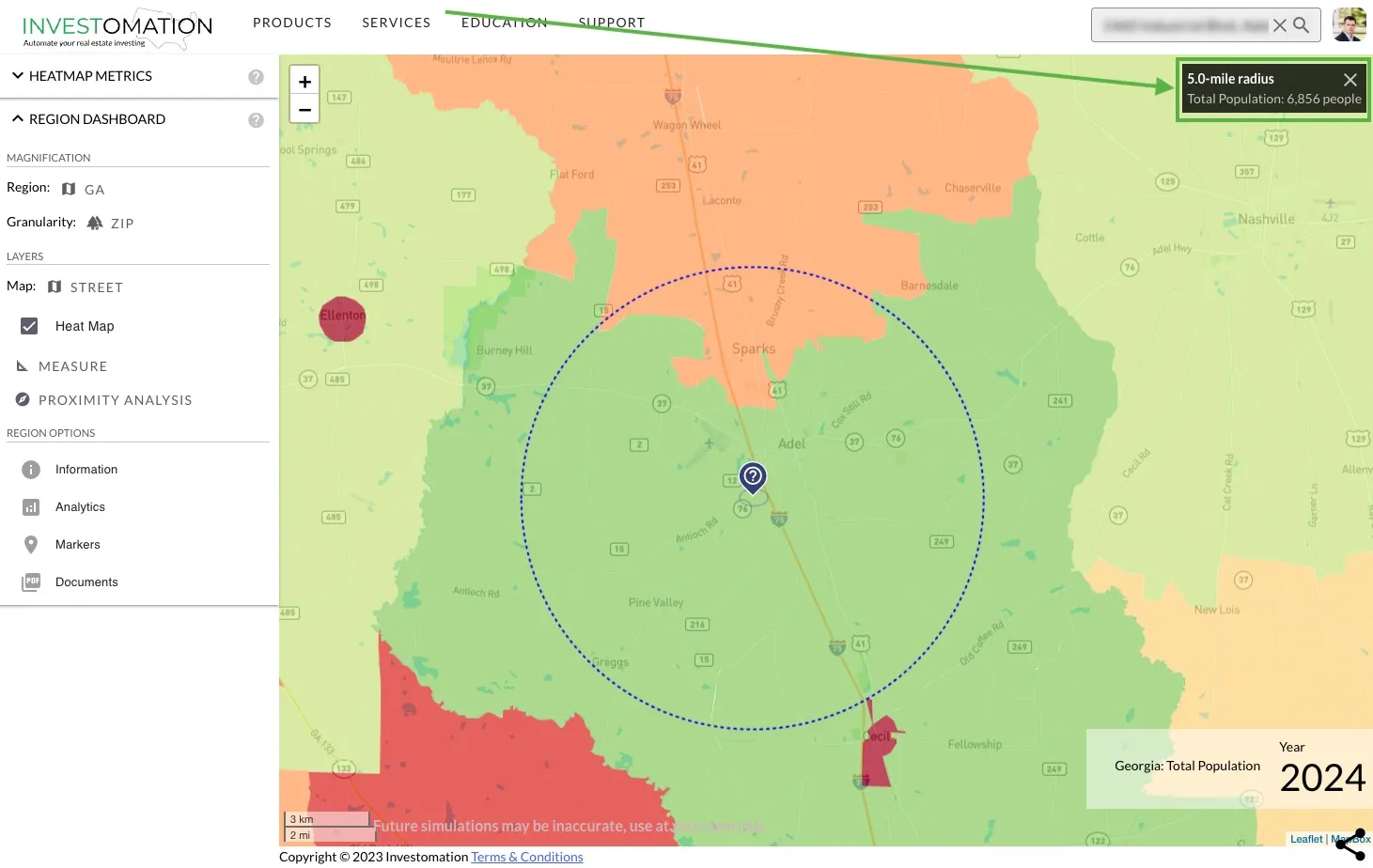

Then, from Region Dashboard we select Proximity Analysis and click on the marker that got generated when we search for our address. This ensures that our analysis is centered around the property of interest. We keep expanding the circle until the radius is 5 miles. Clicking will trigger the analysis, in our case we see that the 5-mile radius population is around 6,850 people.

Now that we know the population, we'll pull up google to search for self-storage in the same city. We identify the facilities within the same 5-mile radius, in our case there are 2. Next we need to understand how large each facility is. We can do this by looking at the facility's website, calling them, or using the Measure tool within Investomation.

Since this is a rural area, neither of the 2 competitors have a website (which is great news for us, if we want to set ourselves apart). However, this also makes our research harder. We could call them directly pretending to be a customer inquiring about the size of the facility, or we could estimate the size ourselves - which is the option I'll focus on.

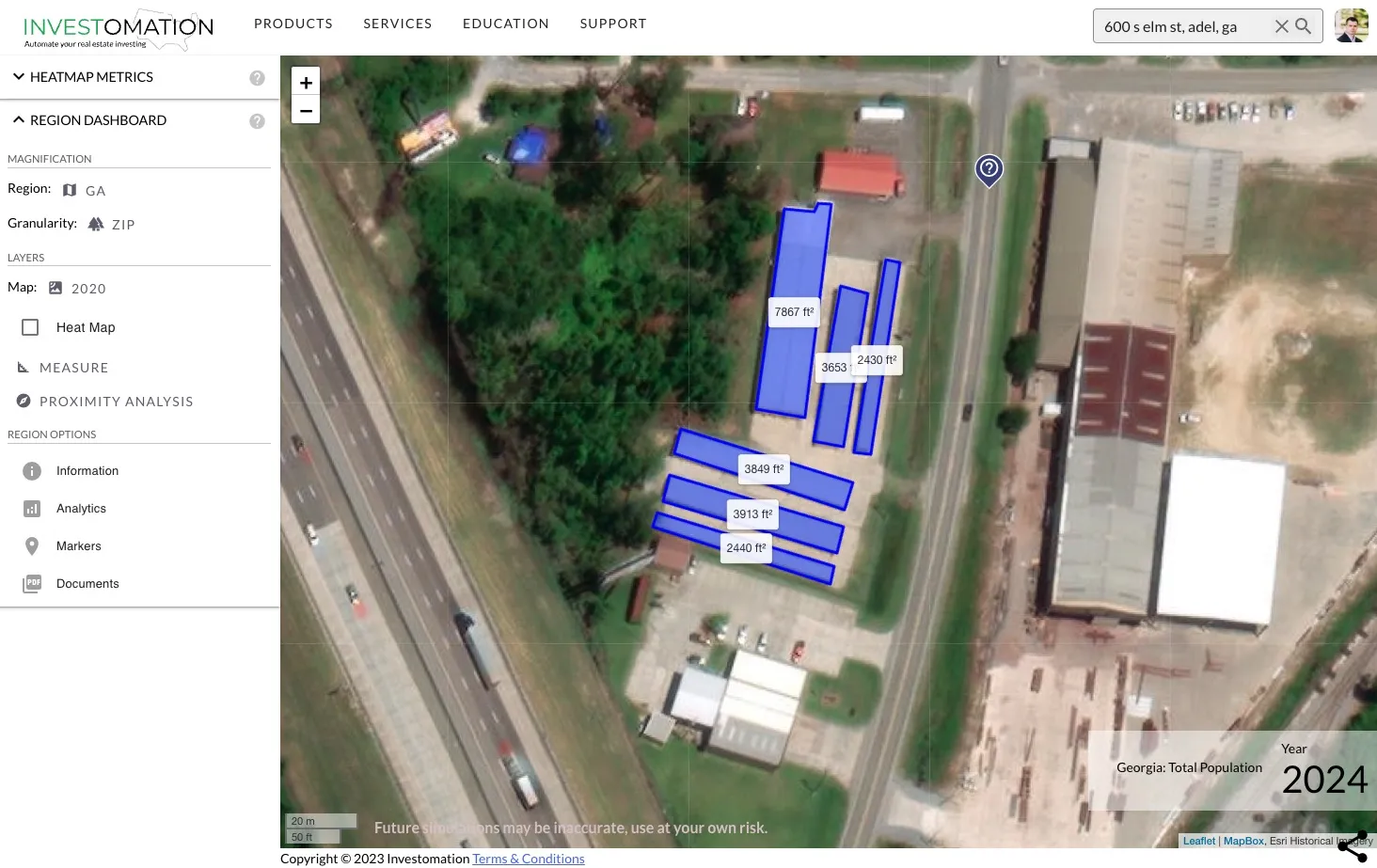

Let's put in the address of the other facility into Investomation to zoom in on it. We then disable the Heat Map and change the map to Satellite to see the actual facility from above. Since most suburban and rural facilities are single-story, we can get a pretty accurate approximation of square footage just by tracing an outline around the facility using the Measure tool, which you can read about here. Within a few seconds of drawing the outline, we see that the total area is 24,000 sqft.

We repeat the same process for the second facility, which ironically happens to be next door to us (one more downside). Using the same approach, we see that it's 13,000 sqft.

The combined rentable area of the 2 competitor facilities is 37,000 sqft, which gives us a ratio of 5.4 sqft/person. That's not bad in itself, but remember that we're buying a warehouse that we need to modify into self-storage. That means us entering the market adds 16,000 sqft of space to this market (not even counting our future expansion), resulting in a ratio of 7.6 sqft/capita. This is usually where I'd stop, since we're above our margin of safety. But for the sake of this example, let's continue.

Growth Rate

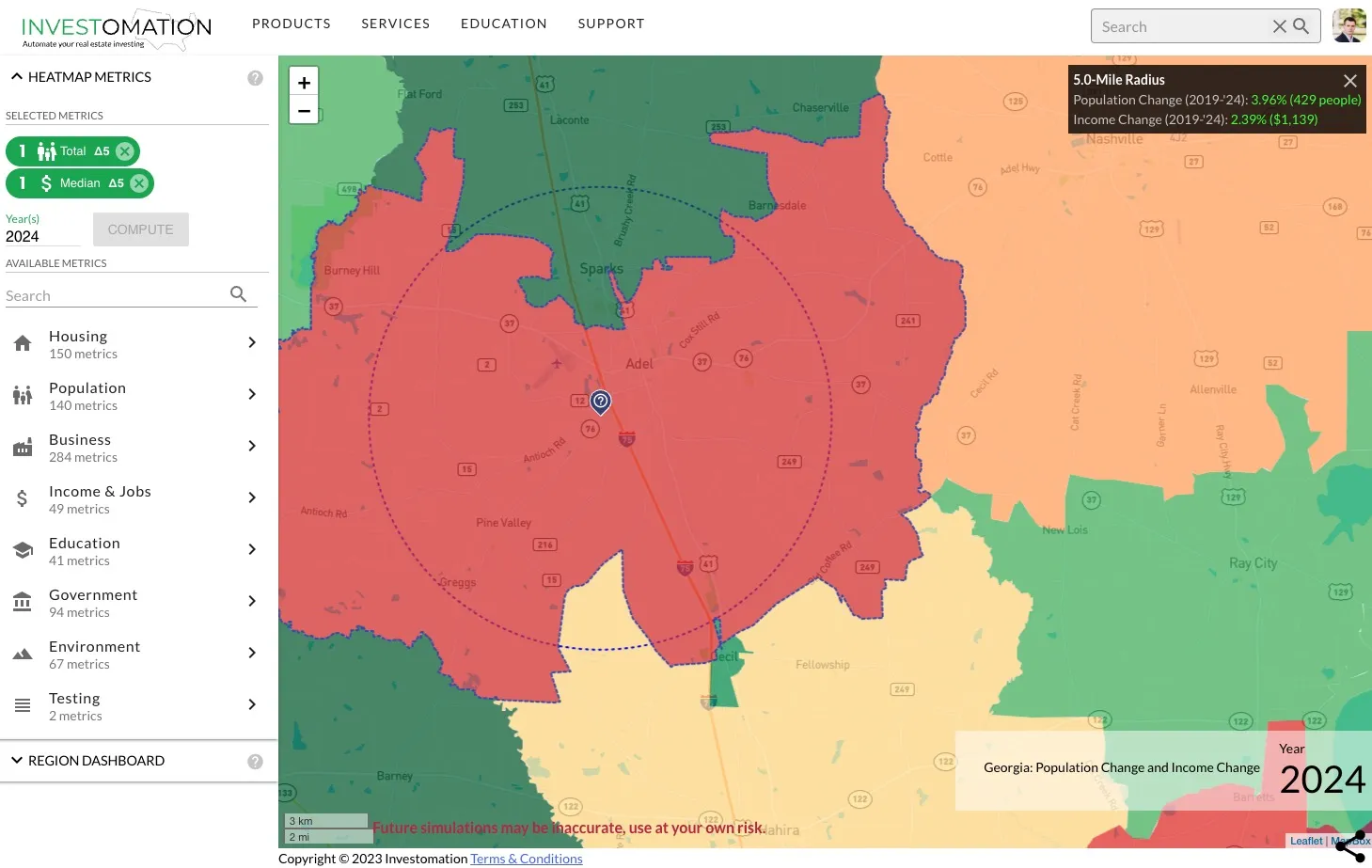

Next we want to check whether this area is growing or declining. To do so, we check population and income growth, both easy to check within Investomation. Once again, we load the map and select Population and Income metrics from the Heatmap Metrics menu. We don't really care about current numbers, instead we want to see the trend. This is where Delta Metrics come in. We navigate into the metric properties for each, and change the delta value to 5 (years). Since this is a rural area, I recommend using a larger delta, since rural data is less accurate. It's the same reason Census offers 1-year, 3-year, and 5-year ACS. 1-year data is better at picking up trends quickly but has too much noise in areas where population is less than 60,000.

We'll repeat the same 5-mile proximity analysis to get the following map:

This area is exhibiting slight population and income growth, but again keep in mind that this is rural data, so there is more noise. Indeed, if you click around on neighboring zip codes, you'll see income growth data fluctuate wildly. And this makes sense, the fewer data points we have, the less reliable the statistics are.

Occupancy, Rates, Fill-up and Unit Mix

Occupancy can be gauged by either calling the competitors or going on their website. This is typically the part I save for the due diligence phase as it can get time-consuming. Same goes for rates, you simply call the competitors pretending to be a customer and ask them how much they charge for each type of unit.

Fill-up is harder to gauge, you'll have to find a recently built facility and compare its rates and perks to existing facilities. For example, in my last blog post I put up a picture of a facility offering 6 months of free rent. That's probably something a new facility would do to attract tenants quickly. Likewise, do you see one facility offering a ridiculous discount compared to competition? That's a sign of a new facility. Keep track of how long these discounts last, as it's an indicator of how long it takes to fill up.

Future Supply

Another metric that's hard to gauge without doing extensive due diligence. You will probably have to call the city or county office and ask them about approved permits for new self-storage facilities. Remember that this is public information, so you can simply ask for it. Ironically, as I was doing due diligence on the property in question, one new facility started coming up in Google search results. It does not yet come up on Google maps but it does have a website and a Facebook group that appeared in the last 2 months.

This facility is 31,000 sqft, completely oversaturating the market. To add insult to injury, it's climate-controlled. There is no way our warehouse, requiring at least $200k of capital to be converted to a proper self-storage facility can compete in this market. This is why future supply is such an important metric. And this goes back to the point I made earlier, no matter how good my analysis is, there will always be surprises that I miss.

With 11 acres of land, it may be a good mobile home park or a farm, but self-storage is definitely not the play here. Moreover, given the additional cost that would be involved in converting this space to a use that would cashflow, it's hard to justify the price being asked based on the land alone.